- EU nations can use home-grown rules to draw crypto ventures.

- Some nations are ahead of others as MiCA looms.

- December deadline may be extended under certain circumstances.

As the European Union’s crypto rulebook edges closer to its enforcement date, regulators and crypto companies are running out of time to plan for this game-changing regime.

In less than 12 months, the Markets in Crypto-Assets regulation, or MiCA, will permit crypto firms to apply for a licence in one EU member state and garner access to all the rest.

That means crypto platforms can instantly do business across the EU’s $19 trillion market.

But with this opportunity comes a big question: Which nation should a crypto company settle in?

Attracting crypto firms

Coming up with answers is complicated because national regulators have leeway to tailor their own rules under MiCA, and many are fashioning ways to attract crypto companies.

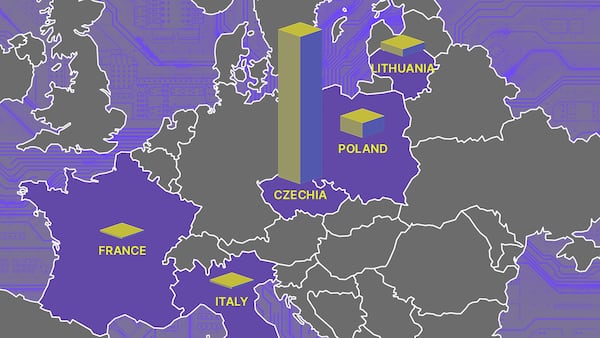

“If a country already has experience dealing with one specific type of services, it makes a lot of sense they will keep attracting those,” Elizaveta Palaznik, an independent consultant specialising in MiCA told DL News in a live interview.

Luxembourg, for example, is already attractive to investment funds, Palaznik said. The grand duchy bordering France and Germany hosts 3,600 investment funds, and so crypto funds are also flocking there.

Ireland’s plan

Ireland’s regulators are known to be friendly to Big Tech firms and to digital finance. This is why firms such as Coinbase and Ripple have chosen to settle in Dublin ahead of MiCA’s enforcement, which starts at the end of this year.

France has attracted trading platforms and exchanges, Palaznik noted. And Malta has drawn web3 gaming platforms.

Indeed, France and Malta have already installed regimes that are similar to MiCA. So firms registered there now may have fewer difficulties gaining crypto licences when MiCA goes live.

MiCA was passed into law last summer after years of negotiations among lawmakers, and is considered the first comprehensive bespoke crypto regulation in a major jurisdiction. Regulators are preparing to implement the new laws over the coming months.

‘Grandfathering’

MiCA’s crypto licensing regime is meant to go live on December 30. Still, a provision in the regulations allows European countries to choose whether to give crypto firms as long as an additional 18 months to adapt. This is known as the “grandfathering” period.

Firms that are already registered with the regulator have an additional period when they can offer their services domestically and prepare for the new, tougher licensing regime.

At the very latest, crypto platforms will need to comply with MiCA by July 1, 2026, if a country opts for the full 18-month period.

“I’ve heard some rumours that in Luxembourg, regulators will go from 18 to 12 [months],” Palaznik said, adding that Ireland and Austria also opted for the extra 12-month transition period.

Lithuania, however, will not offer any extra transitional time for crypto firms. Lithuanian authorities said in December that they are tightening requirements for crypto “in order to manage risks.”

The European Securities and Markets Authority, which oversees the implementation of MiCA, in October urged national authorities to minimise the grandfathering period and limit the grandfathering period to 12 months.

“Some regulators, as far as I know, of course they really want to make this December 30 deadline certain for crypto firms,” Palaznik said. “So firms already know what they are required to do.”

Watch the full conversation between DL News’ regulatory correspondent Inbar Preiss and Elizaveta Palaznik here: