- Regulators and the industry struggle for the soul of crypto in a series of court battles.

- Here are the lawsuits to look for in 2024.

A version of this story appeared in our The Guidance newsletter. Sign up here.

GM, Joanna here!

The US crypto industry weathered a blizzard of lawsuits and enforcement actions this year. Don’t expect the storm to calm in 2024.

The Securities and Exchange Commission’s “campaign of regulation by enforcement will continue,” Ripple Chief Legal Officer Stuart Alderoty told DL News.

The industry monitored every twist and turn in Ripple’s lawsuit this year. It’s seen as a test case for SEC Chair Gary Gensler’s assertion that most crypto assets are securities, and therefore fall under his authority.

That assertion underpinned every case the SEC brought against major crypto players in 2023 — including the world’s biggest exchange, Binance, and the biggest US exchange, Coinbase.

The Commodity Futures Trading Commission was no slouch either, bringing 134 enforcement cases against digital assets businesses, mostly targeting alleged fraudsters.

Along with the US Treasury Department, it took part in the record-breaking $4.3 billion settlement with Binance.

Many of these lawsuits will be resolved. Some will drag on. New ones will no doubt be filed.

Here are some to watch.

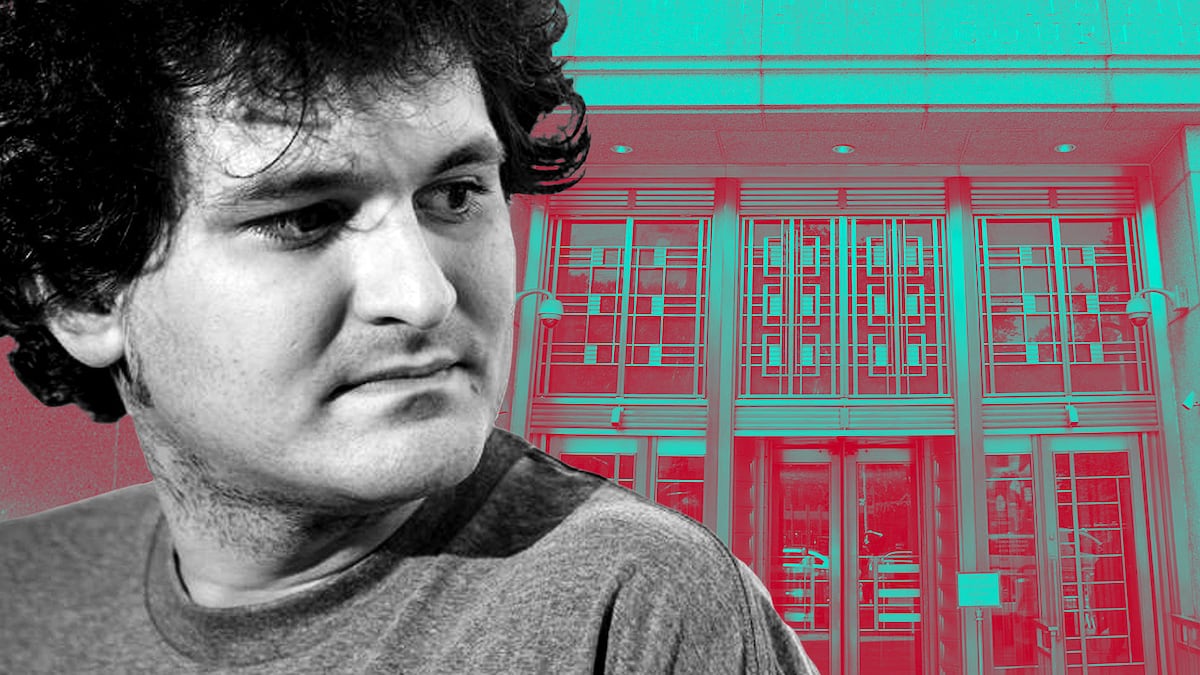

FTX

One-time crypto wunderkind Sam Bankman-Fried is awaiting sentencing on March 28. He was convicted of all seven counts of fraud and money laundering in one of this decade’s most sensational financial crimes trials.

March could also see Bankman-Fried subjected to a second trial over hundreds of allegedly illegal political donations and charges that he bribed Chinese officials.

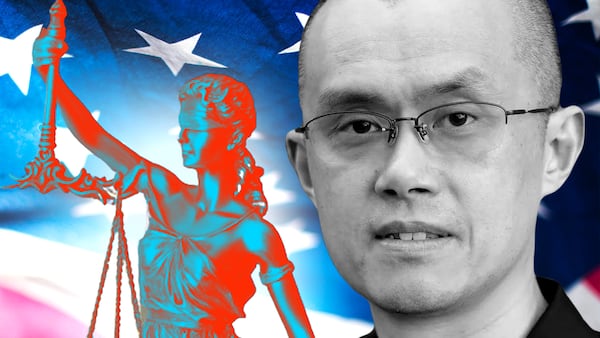

Binance

The SEC is still going after Binance, even though the exchange inked a deal with several other agencies in November.

The SEC has charged Binance with violations of securities laws, including operating an unregistered exchange, and the unregistered offer and sale of its BUSD stablecoin.

Binance’s new CEO, Richard Teng, must now guide the company through an SEC lawsuit, as the regulator did not settle its own case along with the other agencies.

Binance’s former CEO and co-founder, Changpeng Zhao, stepped down and pleaded guilty to one felony charge in November and his sentencing is scheduled for February 23. He could spend 18 months in prison.

Coinbase

Coinbase will fight its own SEC lawsuit in the Southern District Court of New York.

The SEC sued Coinbase in June, alleging it had failed to register as an exchange, and to register its staking-as-a-service programme.

The exchange is trying to get a court to compel the SEC to write crypto-specific rules — a move that some see as part of an ongoing PR campaign against the regulator.

Kraken

Kraken will fight the SEC’s lawsuit in 2024. The agency alleges that Kraken was operating an unregistered exchange and commingling customers’ funds with its own.

In response, Kraken’s CEO David Ripley said that, counter to Gensler’s refrain, Kraken does not list securities, and that there is no clear path for firms like his to registration with the SEC.

Ripple

Next year could see the culmination of the SEC’s multi-year legal fight with Ripple, which started when the agency alleged that the sales of XRP tokens to institutional investors and on the exchange represented an unregistered security.

The SEC suffered what the industry chose to take as a defeat in July, when Judge Analisa Torres decided that XRP’s sale on the exchange did not constitute an unregistered security. while sales to sophisticated investors did.

All that’s left now is for the two sides to hammer out the penalties Ripple may owe for the sale of XRP to institutional investors. Either side can appeal these decisions.

Celsius

Alex Mashinsky, co-founder and former CEO of Celsius, is slotted to face the court on September, the outcome of which will determine how regulators’ cases against the bankrupt lender will play out.

He was arrested in July on seven criminal charges that alleged defrauding and lying to customers.

At the same time, Celsius was hit with a barrage of civil lawsuits from the SEC, CFTC, and Federal Trade Commission.

The FTC settled its lawsuit with Celsius, while the other two civil suits are paused pending the outcome of the criminal trial.

Tornado Cash

The cases against crypto mixer Tornado Cash will plough on in 2023, with developer Alexey Pertsev’s trial in the Netherlands being scheduled for March 26 and 27.

In the US, Tornado Cash co-founders Roman Storm and Roman Semenov will continue their fight against accusations of facilitating money laundering and sanctions evasion. Storm pleaded not guilty in a Manhattan court in September. Both sets of plaintiffs are appealing.

The US Treasury sanctioned the popular Ethereum-based mixer in August 2022 for facilitating money laundering.

Industry players filed lawsuits and assailed the Treasury for violating Americans’ financial freedom and Constitutional right to free speech. Two of those lawsuits have been thrown out by the courts.

Email me joanna@dlnews.com, or Telegram @joannallama.

Do Kwon’s extradition to be reheard after Montenegro court finds ‘significant violation’ of procedures

Do Kwon’s extradition is going back to square one.

In a decision that will slow down a potential extradition of indicted crypto entrepreneur from Montenegro, an appellate court last week annulled the decision of a lower court and ordered the process to begin again.

The surprise ruling did not challenge the merits of the lower court’s decision in November to extradite Kwon to either the US or South Korea.

Prosecutors in both nations have charged Kwon with fraud in connection with the $60 billion collapse of the Terra blockchain network in May 2022.

Post of the Week

Crypto companies are spending millions building an army of former defense and law enforcement officials to lobby against new rules shutting down crypto-financed terrorism. This revolving door boosts the crypto industry, but endangers our national security. https://t.co/OGnrL0VKdH

— Elizabeth Warren (@SenWarren) December 19, 2023

Anti-crypto firebrand Elizabeth Warren lashed out against crypto lobbyists, and got community noted on X.

Comment of the Week

Ireland and the EU “are boosting confidence in the digital assets, payments and fintech ecosystem,” said Ripple’s Eric van Miltenburg as the firm announced its new European hub in Dublin.