- The Blockchain Association files brief to support reinstatement of lawsuit connected to Tornado Cash case.

- Coinbase is also urging appeals court to recognise that Tornado Cash should not have been sanctioned.

- Coin Center is backing a similar legal challenge in federal court in Florida.

The top crypto industry lobbying group in Washington on Monday threw its support behind the latest bid by six plaintiffs to reverse the US government’s sanction of Tornado Cash, the crypto mixer.

In a 39-page brief filed in federal appellate court in Texas, the Blockchain Association argued that the US government made a mistake because Tornado Cash is a tool built on software code, not a person or company.

“This software has no owner or operator, and it functions automatically without any human intervention or assistance,” argued the group’s lawyers from Jones Day, the well-connected law firm in Washington.

“Like any tool — indeed, like the internet itself — software like Tornado Cash can be misused for illicit purposes. But it is used primarily for legitimate and socially valuable reasons.”

Long shot case

Last week, a group of DeFi experts led by Ethereum core developer Preston Van Loon asked a Texas appeals court to reinstate their lawsuit against Tornado Cash. In August, a lower court judge threw out the complaint after finding it lacked sufficient evidence.

While overturning the judgement is a long shot, the case brought by the Van Loon Six has become a cause célèbre in the crypto industry. Coinbase filed its own so-called friend of the court brief last week. Now the Blockchain Association has followed suit.

Their argument is that if the sanctions are left to stand, it would weaken the crypto asset industry, block the lawful use of the protocol, and hand the Office of Foreign Assets Control (OFAC) excessive power to target lines of code not owned by anyone.

Tornado Cash is a crypto mixer, or a decentralised protocol that obfuscates the history of crypto transactions.

The industry argues that Tornado Cash is a valuable innovation that can promote privacy on immutable blockchains that publicly display every transaction.

The US Treasury Department’s Office of Foreign Assets Control, or OFAC, sanctioned the protocol in August 2022, alleging it was used by a North Korean hackers group to launder dirty money. Since then, multiple developers, including Alexey Pertsev, have faced legal charges.

‘A hammer is a tool, a car is a tool, indeed the internet itself could be considered a tool.’

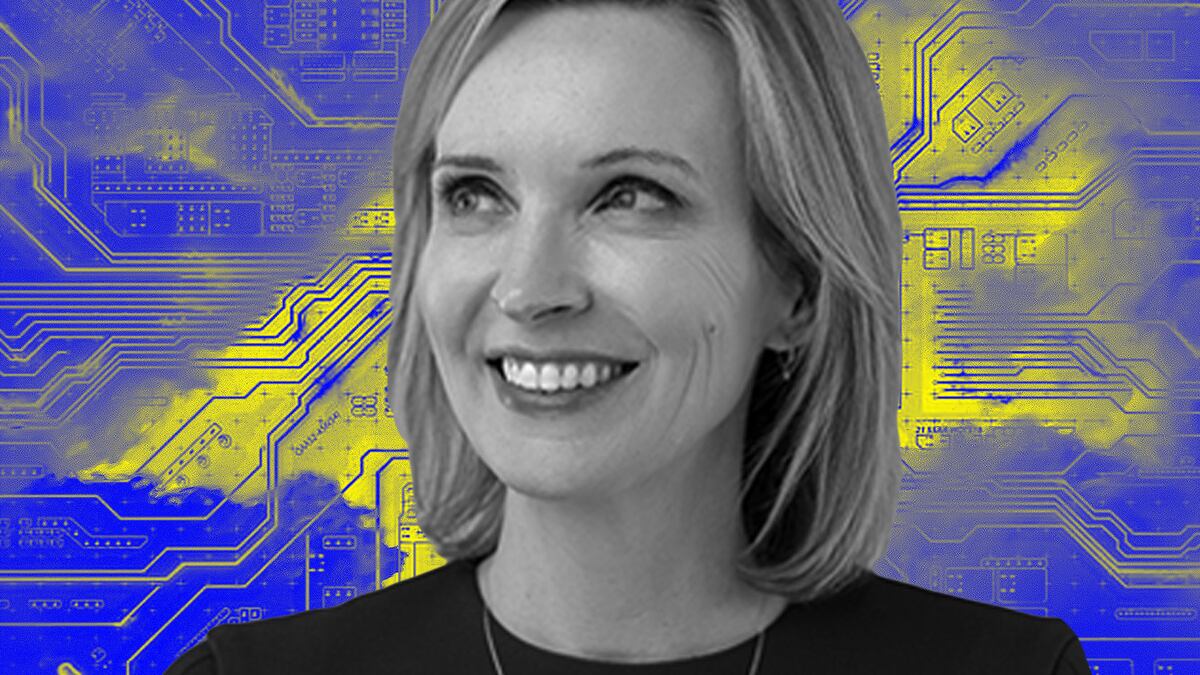

— Kristin Smith, Blockchain Association

While the programme can be used to hide illicit transactions, advocates for the technology argue that its sanctioning is a violation of the first amendment.

The Blockchain Association previously filed a so-called amicus brief in April in support of Van Loon and his fellow plaintiffs’ initial lawsuit.

“A hammer is a tool, a car is a tool, indeed the internet itself could be considered a tool,” Kristin Smith, Blockchain Association CEO, said at the time. “Ordinarily, OFAC would not consider sanctioning neutral tools used by some people for illicit activities, it would sanction the people committing those activities.”

The lobby group is based in Washington DC and represents industry giants such as Coinbase, Kraken, Circle, eToro, Grayscale and Polygon Labs.

Coinbase — the top-listed crypto exchange that spent $1.4 million on lobbying for crypto in the first half of 2023 — also joined the chorus independently in support of Tornado Cash.

“Congress gave Treasury the power to prohibit transactions involving certain ‘property’ in which a foreign ‘national’ or sanctioned ‘person’ has an interest,” Coinbase Chief Legal Officer Paul Grewal posted on X last week.

“Treasury’s action here stretches that authority and those words beyond any recognition.”

A parallel effort to reverse OFAC’s sanctions on Tornado Cash comes from Coin Center, an additional advocacy group. Their lawsuit against OFAC was dismissed at the end of October.

Coin Center’s director of communications, Neeraj Agrawal, told DL News they plan to appeal.

If you have a tip on Tornado Cash legal proceedings, contact the author at inbar@dlnews.com.