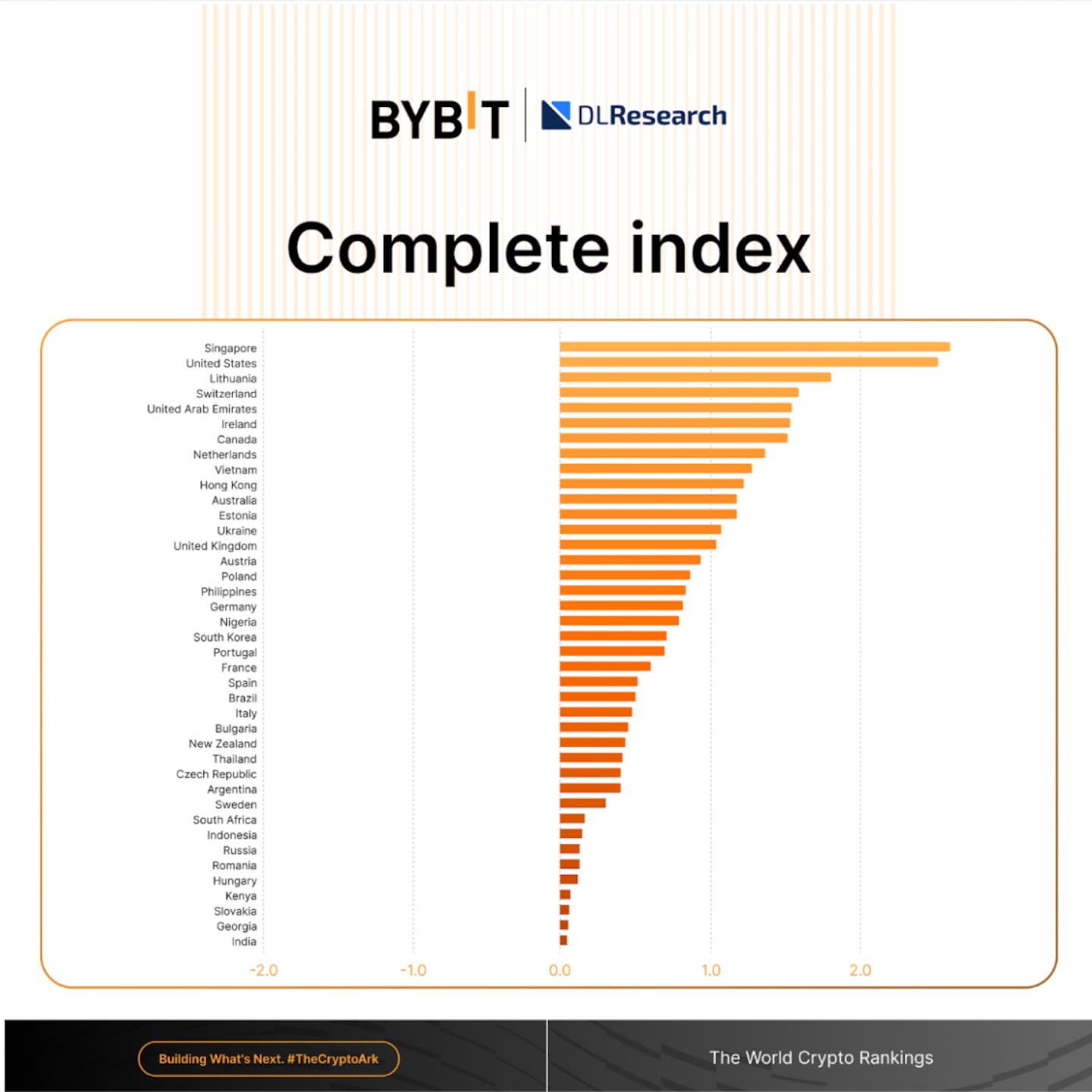

We often treat crypto adoption indices as scoreboards. We look for who is at the top, assume the rankings validate our existing biases, and move on. However, the real value of deep data lies in where it contradicts our expectations.

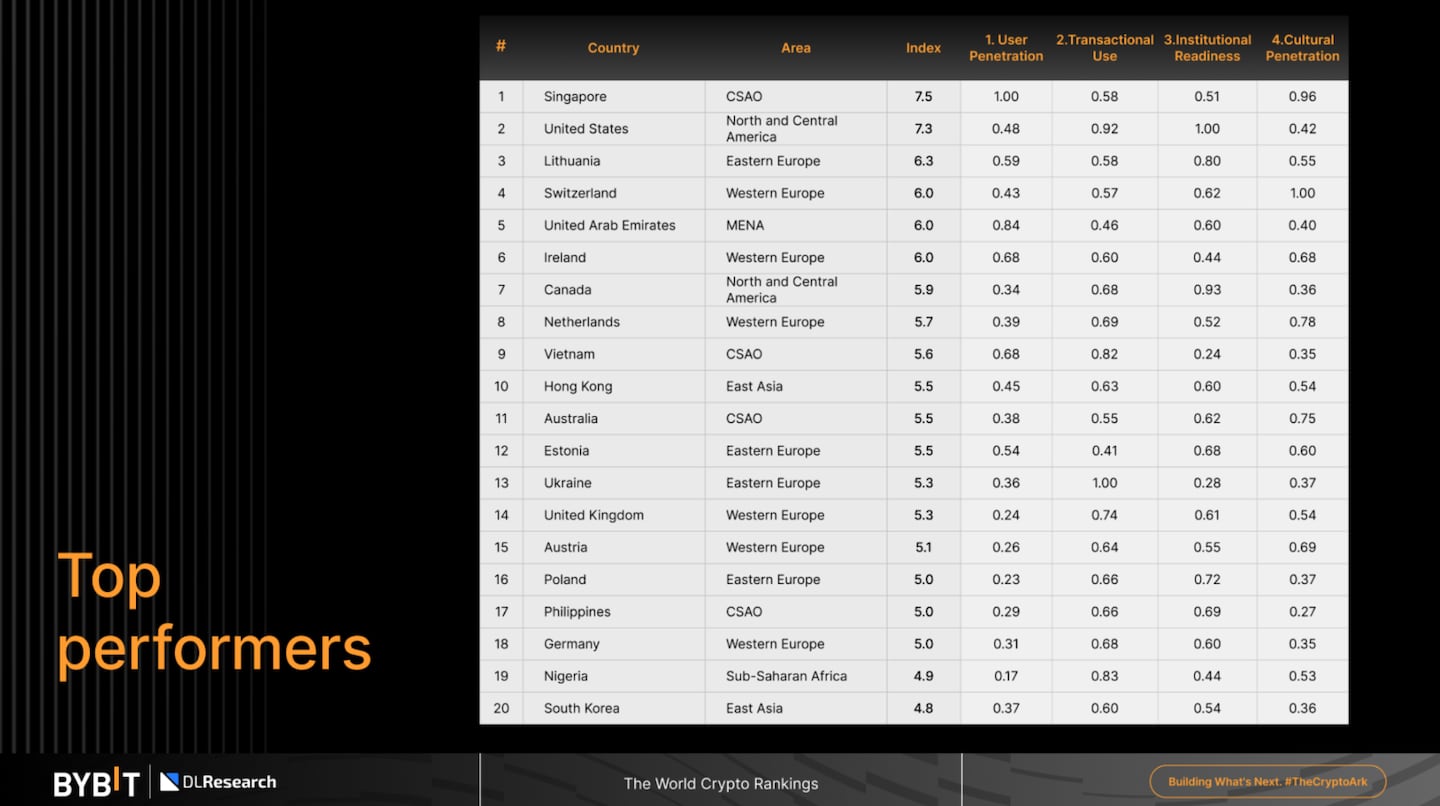

Following our introduction to the Bybit World Crypto Rankings Index, we now turn to the anomalies. While the aggregate rankings give us the broad view, the Index serves as a stress test for common industry assumptions when we drill down. Looking past the headlines into the specific pillars (user penetration, transactional use, cultural penetration, and institutional readiness), a complex picture emerges.

The data suggests that adoption follows multiple, often contradictory paths. It is frequently at odds with expectations about wealth, policy, or narrative. The following analysis explores the key surprises where the data diverged from the consensus view.

When usage, not wealth, drives crypto financial activity

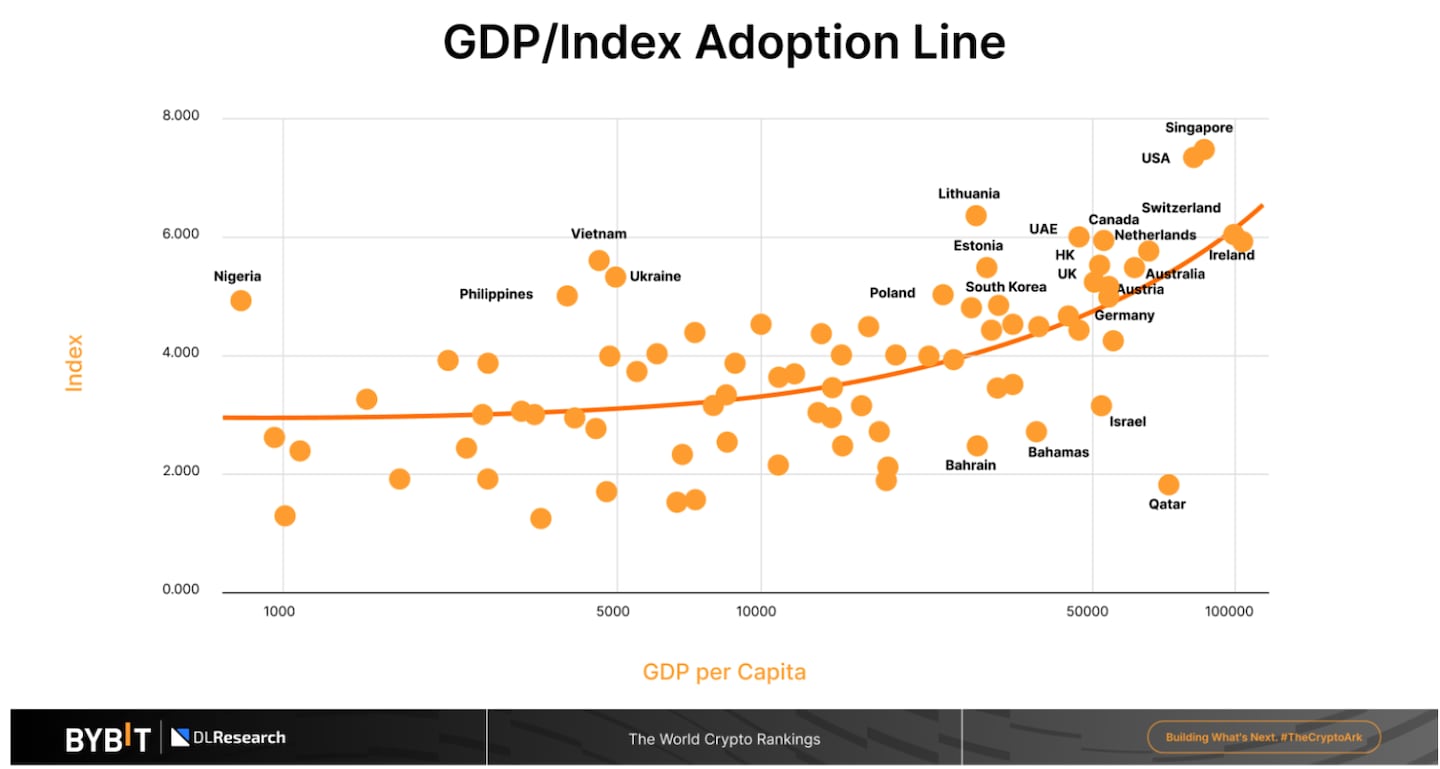

The most persistent narrative in global finance is that higher GDP per capita leads to greater financial activity. In traditional markets, this rule generally holds true. In the crypto economy, the Index suggests otherwise.

There is no consistent correlation between a country’s GDP per capita and its crypto transaction volume. This disconnect challenges the idea that crypto is purely a luxury good or a speculative toy for the wealthy.

The data highlights nations such as Nigeria, Vietnam, Ukraine, and the Philippines as leaders in transactional use, despite being classified as lower- or middle-income economies. Nigeria is a prime example of this divergence. While its user penetration score stands at a modest 0.17, its transactional use score skyrockets to 0.83.

Ukraine presents a similar anomaly, boasting a perfect transactional use score of 1.00 despite relatively low cultural penetration. In these markets, crypto is clearly anchored in necessity rather than novelty. It functions as a rail for remittances, a shield for savings, and a method for payments. Transactional use behaves differently from every other pillar in the Index because, for these populations, it serves as an essential utility rather than an optional investment.

A split between everyday use and capital deployment

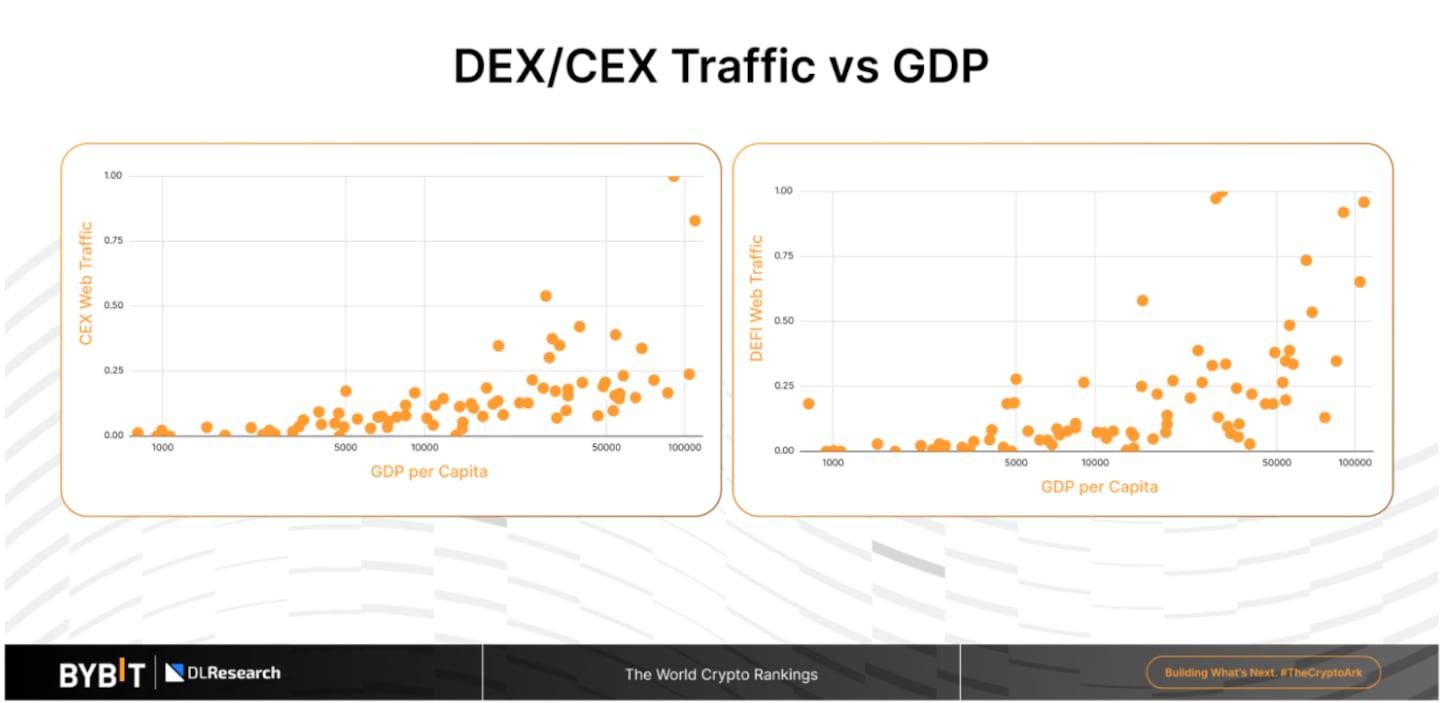

While everyday transactional use defies economic stratification, investment infrastructure data tells a different story. Traffic to Centralised Exchanges (CEXs) and Decentralised Exchanges (DEXs) strongly correlates with GDP per capita.

High-GDP countries dominate the traffic stats for major exchanges and DeFi protocols. This suggests that wealth enables participation in sophisticated financial instruments. Accessing a browser-based DEX to yield farm, or trading derivatives on a CEX, remains an activity for the capital-rich.

Conversely, lower-GDP markets tend to rely on stablecoins, Peer-to-Peer (P2P) rails, and mobile-first access points. The takeaway here is a sharp bifurcation in utility. Wealth guarantees access to financial casinos and yield products, but it fails to guarantee everyday crypto use. The “utility” of crypto changes depending on the user’s economic reality.

Latin America’s split personality

Regional analysis often falls into the trap of treating continents as monoliths. The Index reveals that Latin America does not follow a single adoption model. Instead, neighbouring nations exhibit radically different behaviours driven by distinct local pressures.

Brazil appears as a hybrid market. It combines regulatory progress with growing retail use, particularly in stablecoin-driven remittance corridors. It acts as a bridge between the institutionalised North and the necessity-driven South.

Argentina, by contrast, is a market defined almost entirely by necessity. Decades of inflation and strict currency controls have forced the population to turn to crypto as a survival mechanism.

Mexico operates on a third model, heavily reinforced by cross-border flows with the United States. The lesson here is that geographic proximity does not imply uniform adoption dynamics. Local economic pain points act as the primary architect of crypto behaviour.

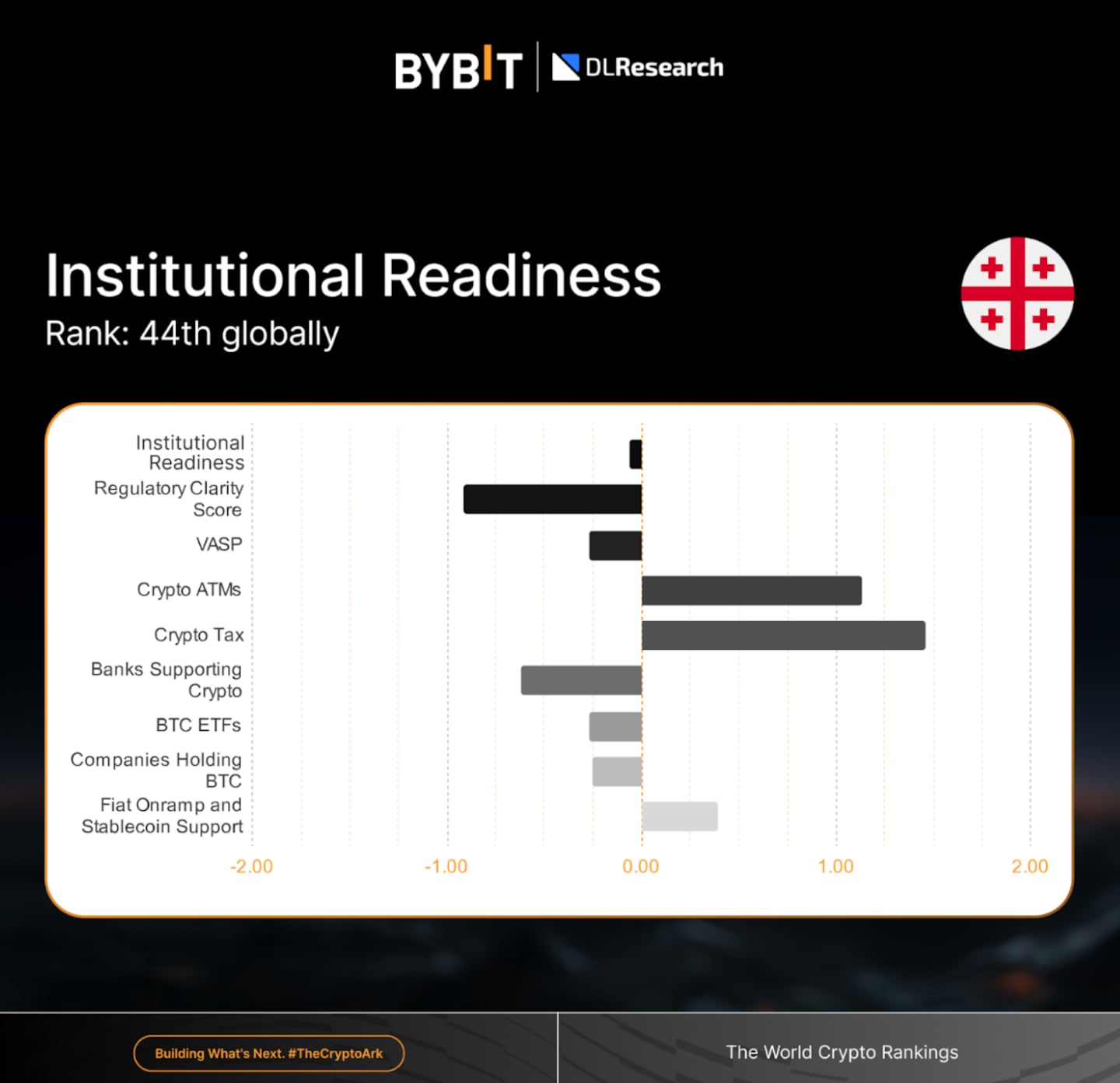

Infrastructure-led adoption in the Caucasus

One of the quieter surprises in the Index is the robust adoption scores seen in Georgia and Armenia. This activity is not necessarily driven by consumer mania but by mining.

The availability of energy, combined with high remittance flows and regulatory openness to crypto-related investment, has turned the region into a mining hub. This suggests that infrastructure-led adoption can precede consumer adoption. By establishing the hardware and the regulatory rails first, these small states have punched above their weight in the rankings.

Small states, smart policies, large influence

Scale is often assumed to be the deciding factor in global influence, yet the Index highlights that regulatory clarity can outweigh population size.

Small nations like Lithuania, Estonia, and Ireland have emerged as critical gateways for the industry. Estonia has leveraged its long-standing digital-first identity and e-governance legacy to become a hub for licensing Virtual Asset Service Providers (VASPs). Similarly, Ireland is strengthening its role as a European tech capital, hosting traditional fintech giants like Stripe alongside a growing roster of crypto startups.

These nations prove that a country does not need a massive user base to exert massive influence on the ecosystem. Smart policy creates a gravity of its own.

The paradox of culture and institutions

Perhaps the most intellectually stimulating section of the Index is where it highlights the mismatches between cultural interest, institutional readiness, and actual usage.

- Ukraine displays high transactional use but low cultural penetration. People are using the tech without necessarily identifying as part of the “crypto culture.”

- Pakistan shows a stark divide, with an institutional readiness score of just 0.01 against a transactional use score of 0.73. The people have moved forward while the institutions have stalled.

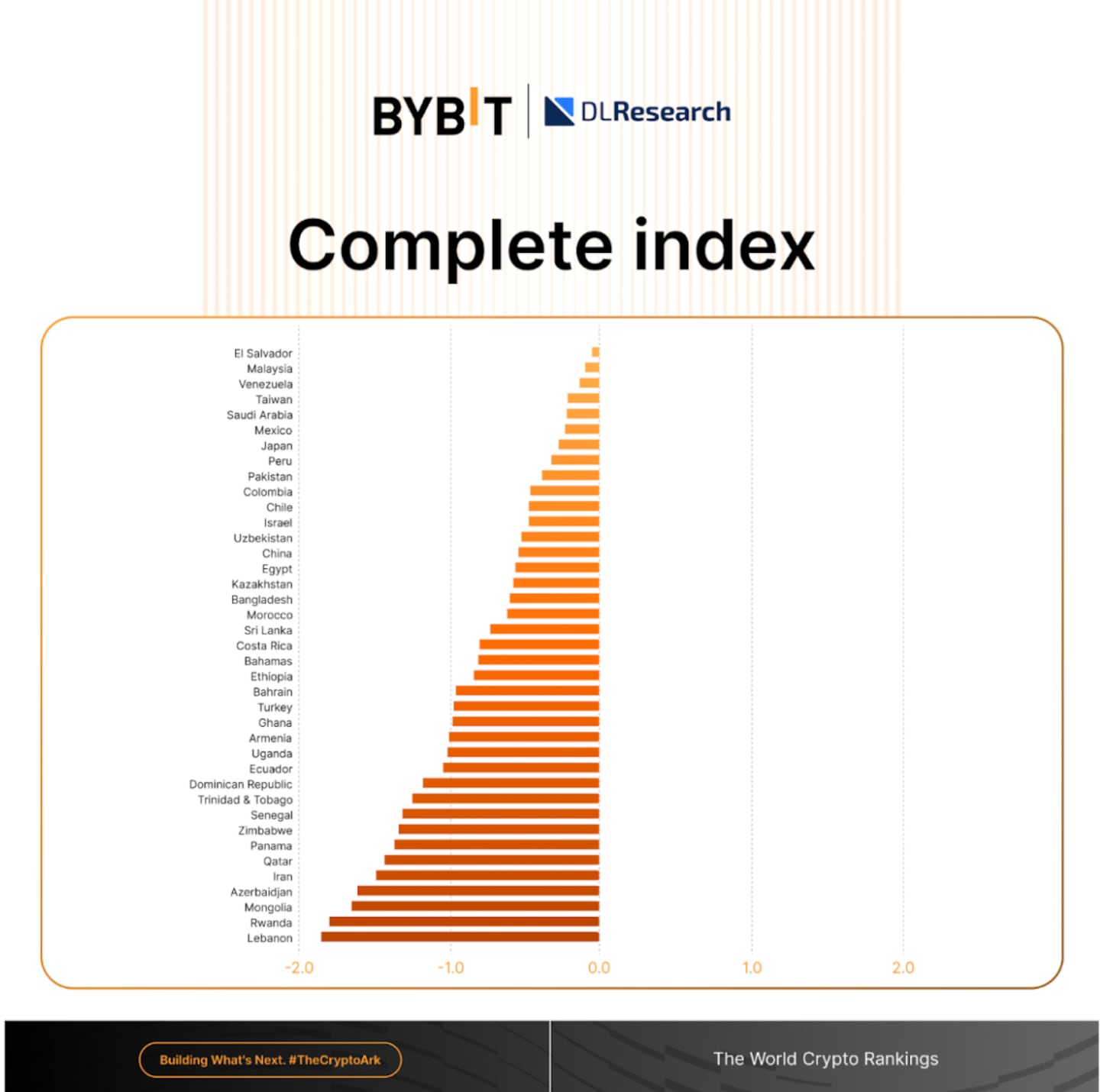

- China remains a fascinating outlier. Despite repeated bans and strict policies, it retains a cultural penetration score of 0.76.

- Turkey offers a counter-narrative to the inflation thesis. Despite strong inflationary pressures and vocal crypto communities, its transactional use score is surprisingly low at 0.06.

- El Salvador provides a reality check for policy maximalists. Bitcoin is legal tender, yet the rollback of mandatory acceptance and other factors leave it with low scores in both cultural penetration (0.13) and transactional use (0.25).

The insight here is that legal status alone is insufficient to generate usage. Culture, infrastructure, and organic incentives prove to be the decisive factors.

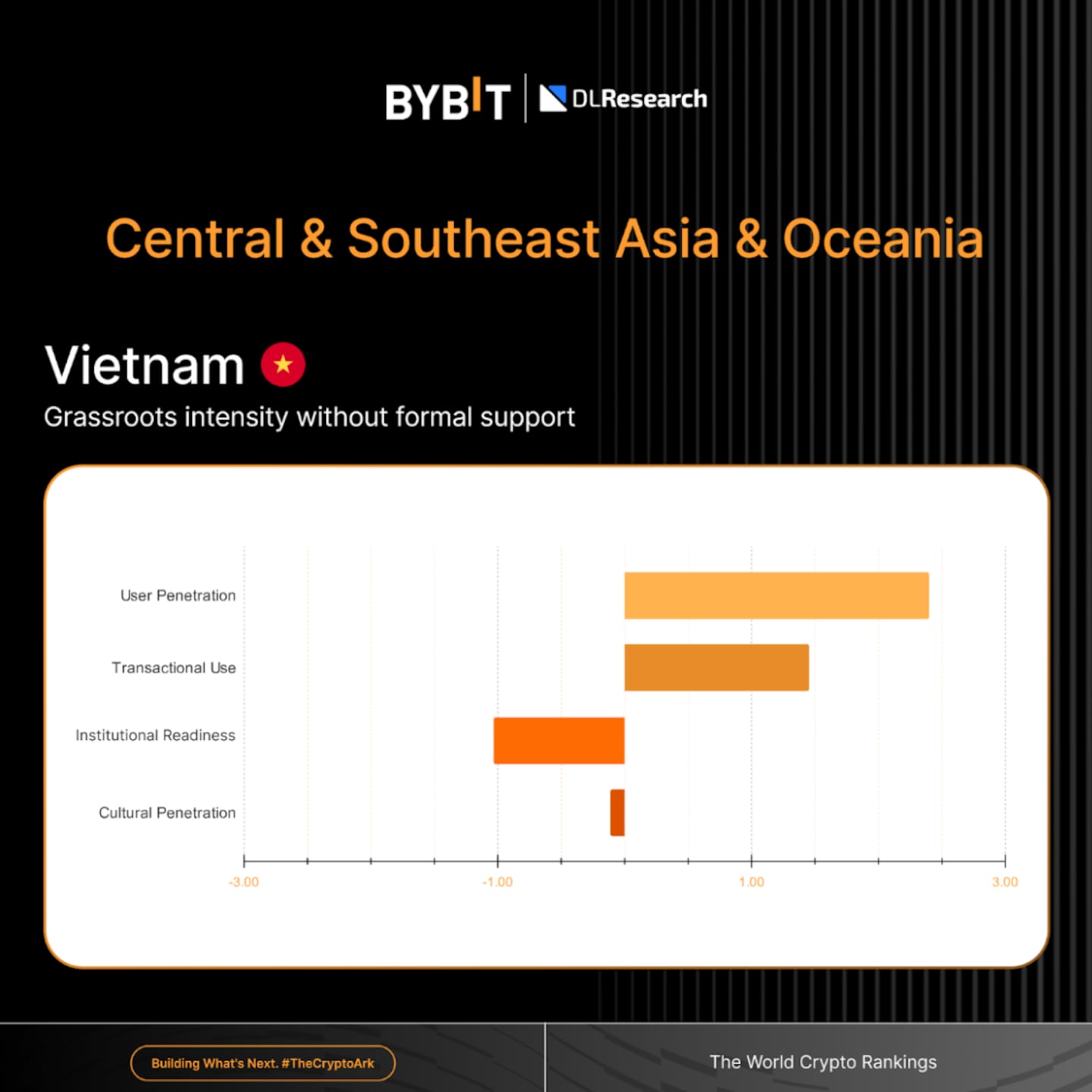

Vietnam’s quiet leap and the P2P shift

The data on Peer-to-Peer (P2P) trading volume offered another correction to standard thinking. P2P traffic is not concentrated solely in low-income countries. Activity spans income levels, shaped more by local banking frictions and mobile money penetration than by poverty alone.

Vietnam stands out in this regard. It is emerging as a global hub for Decentralised Physical Infrastructure Networks (DePIN), outpacing much wealthier economies. With high ownership rates, strong transactional use, and developer activity growing faster than its GDP would predict, Vietnam is positioning itself as a technical leader rather than just a passive consumer market.

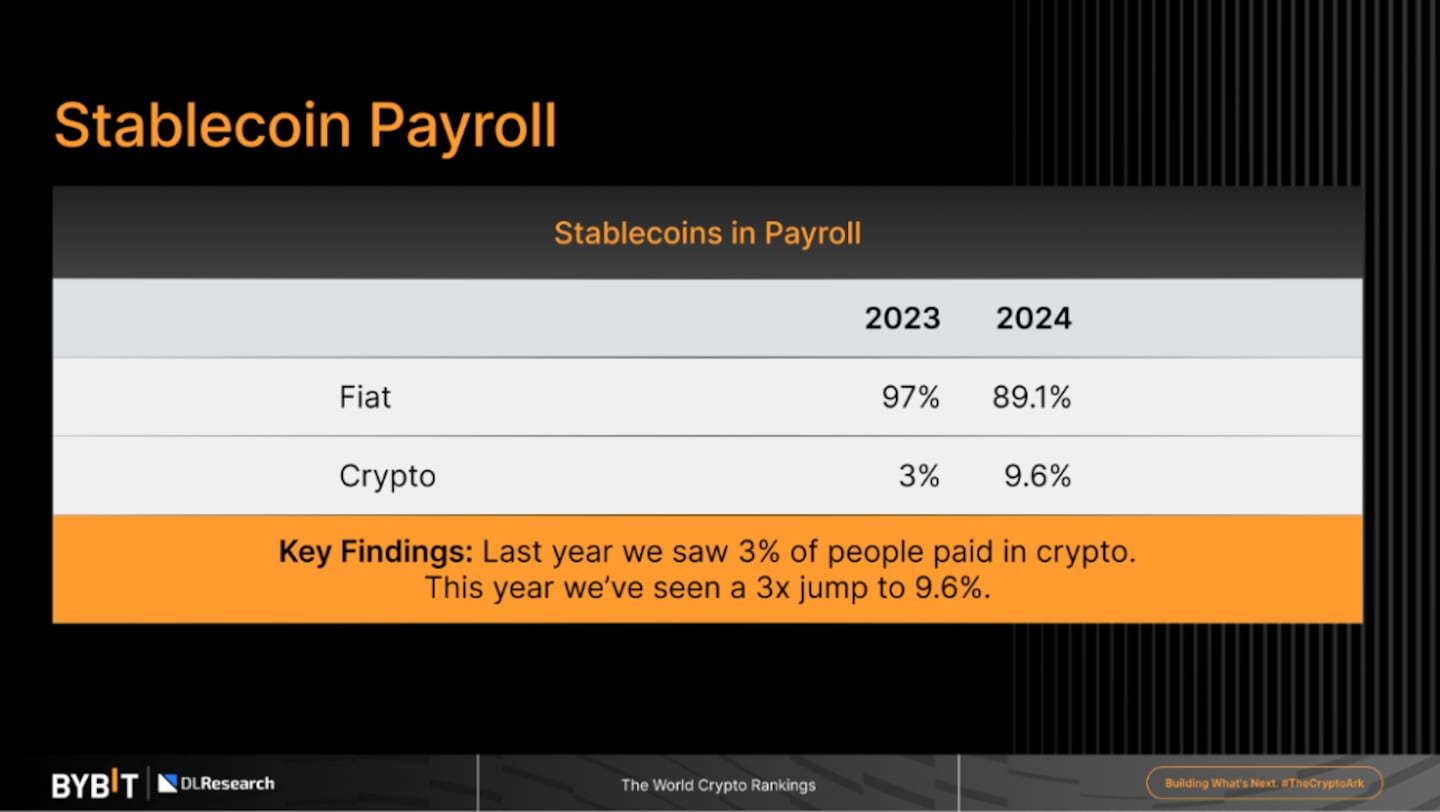

Crypto payroll as a leading indicator

Finally, one of the most bullish signals in the dataset comes from the labour market. As noted in the initial Index overview, crypto salaries are scaling, but the magnitude of the growth is the real surprise. Onchain payroll nearly tripled year-over-year, jumping from 3.2% of workers in 2023 to 9.6% in 2024.

Payroll adoption is significant because it reflects deep trust. A user might gamble with a small percentage of their net worth on a volatile token, but accepting crypto as their primary livelihood signals a fundamental shift in reliability and routine use. This metric often precedes broader institutional or cultural shifts, acting as a leading indicator for the next cycle of maturation.

Conclusion

The core conclusion of the Index is that there is no single formula for adoption. Wealth enables access, but it does not guarantee usage. Policy can lubricate the rails, but it cannot force people to ride the train. Necessity accelerates behaviour, but it does not dictate the form that behaviour takes.

True adoption emerges only where incentives, constraints, and infrastructure align. The “surprises” in the data are simply the market finding the path of least resistance.