The decentralised finance (DeFi) industry has long been addicted to inflationary incentives. In this model, protocols print tokens to lure liquidity, rewarding short-term mercenaries while simultaneously diluting the token’s long-term value.

Katana offers a superior economic thesis: replacing heavy reliance on inflationary emissions with productive capital to reward users who put their liquidity to work. While emissions still exist through both the Katana treasury for strategic deployment and the vKAT gauge voting pool, VaultBridge reduces the dependency on those emissions by supplying a non-inflationary reward stream. Yield from VaultBridge is routed directly to incentives for key DeFi markets, ensuring rewards are earned through activity.

Over time, the plan is to reduce reliance on KAT issuance by funding vKAT-directed emissions through buybacks sourced from chain revenue.

This paradigm shift is driven by AggLayer’s VaultBridge, a unique yield-routing protocol that channels real Ethereum yield back to Katana. VaultBridge converts what would be assets sitting idle in an L1 bridge contract into a recurring revenue stream that scales with Total Value Locked (TVL), establishing a self-funding rewards cycle that is sustainable, transparent, and aligned with core DeFi principles.

This is not emissions. This is real yield powering the flywheel, where active users earn, and idle capital does not.

Intro: A Better Economic Model for Liquidity

In a Layer 2 (L2) environment, assets bridged from Ethereum (Layer 1) traditionally sit dormant in a bridge contract, serving only as collateral. This represents a massive opportunity cost that inflationary chains try to cover with unsustainable token handouts. Katana eliminates this inefficiency by transforming the bridge reserve into an active, yield-generating treasury.

VaultBridge is the mechanism that achieves this. Built for seamless integration and capital efficiency, it ensures that every asset used to secure the bridge is actively generating yield on Ethereum, creating a passive income stream for the Katana ecosystem.

The central takeaway is simple: idle L1 liquidity becomes productive L2 liquidity, replacing the need for token printing with real, sustainable yield. This fundamental difference positions Katana as a leader in economic sustainability, a key prerequisite for institutional confidence.

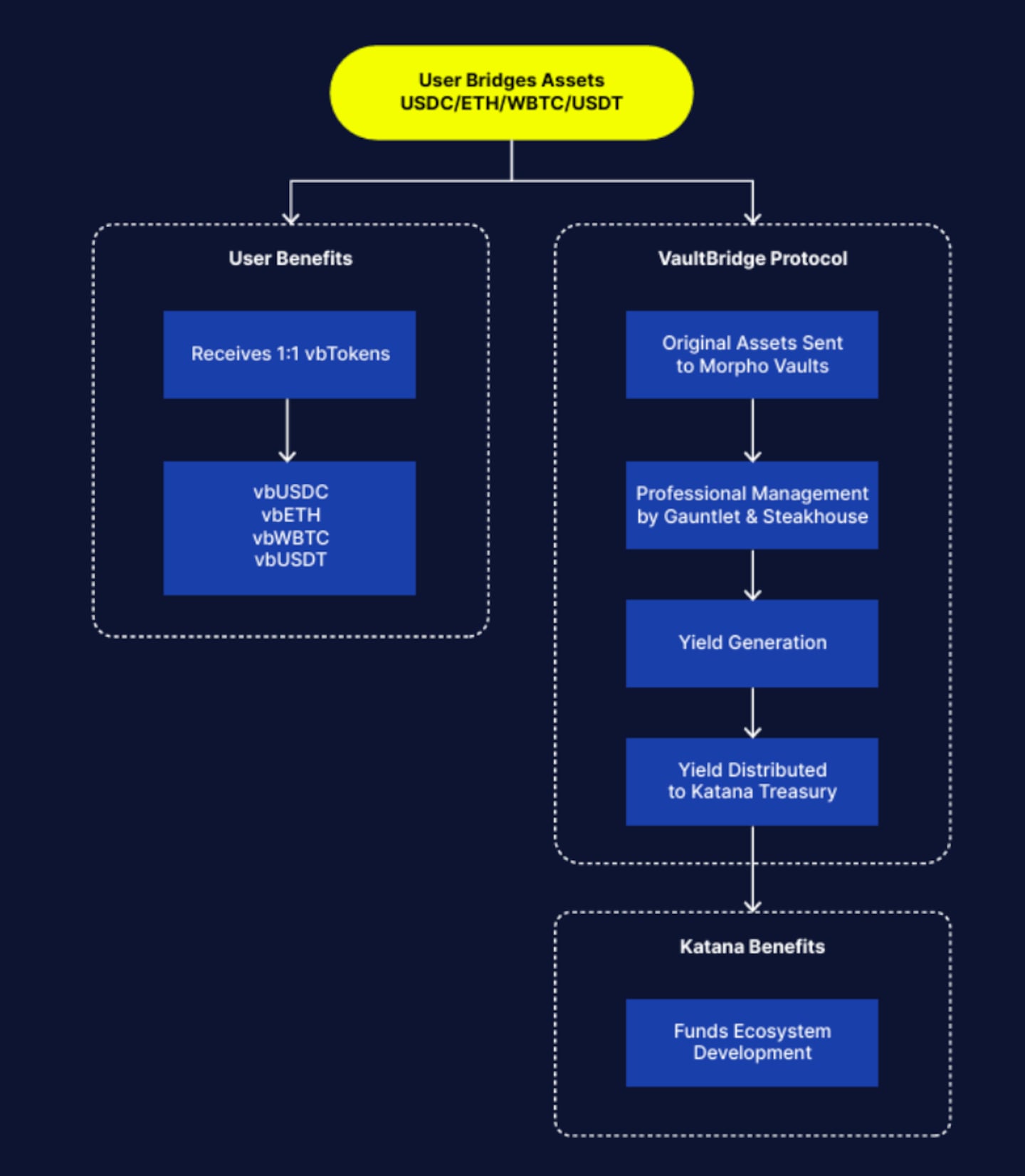

How VaultBridge Works

VaultBridge is a complex protocol that leverages Polygon Labs’ Agglayer team and best-in-class, battle-tested cross-chain infrastructure. Its operation is defined by a rigorous, four-step cross-chain process that ensures security and capital optimisation:

1. L1 Deposit and Yield Generation

When users bridge core assets like ETH, USDC, USDT, USDS, or WBTC to Katana, those assets do not sit in a static escrow on L1. Instead, they are automatically deposited into audited, established low-risk yield-generating strategies on the Ethereum mainnet, specifically utilising protocols such as Morpho vaults. This approach ensures the base capital is always working.

2. Expert Curation and Security

To ensure safety and performance, yield strategies are selected and managed by industry veterans like Gauntlet and Steakhouse Financial. These curators operate on a strictly non-custodial basis, setting strategies for Morpho contracts without ever touching user funds. Their expert oversight prioritises transparent, risk-adjusted returns rather than unsustainable high yields.

This security is reinforced by multiple, independent code audits and an ongoing bug bounty program administered by Cantina, ensuring the highest standards of safety for deposited assets.

3. vbToken Minting and Yield Routing

When users opt for VaultBridge, their assets are deposited into yield-generating strategies on L1. The vbTokens (e.g., vbUSDC, vbWETH) are issued and bridged to Katana. These vbTokens represent the user’s underlying bridged asset on Katana.

Crucially, the L1 yield generated is not automatically accrued to the vbToken. Instead, the yield is streamed back to Katana via secure, escrow-managed contracts, ready to be deployed into the L2 ecosystem’s core markets as incentives.

4. Free Use Across Katana

The resulting vbTokens remain 1:1 redeemable for their underlying L1 assets and can be freely used across all Katana DeFi applications.

This seamless integration means assets are productive from the moment they are bridged, fueling incentives for lending protocols, liquidity pools (LPs), and onchain rewards without user friction. The yield incentives are then applied to users actively utilising these vbTokens in DeFi (lending, borrowing, LPing), rather than just holding them. This provides better incentive alignment for the long-term health and growth of the Katana DeFi ecosystem and increases the overall user experience on Katana.

Perpetual Liquidity Mining

The greatest demonstration of VaultBridge’s power is its ability to fund a perpetually funded liquidity mining program powered entirely by real yield, eliminating Katana’s dependence on inflationary KAT token emissions. This consistent stream of non-dilutive rewards is a game-changer for ecosystem stability.

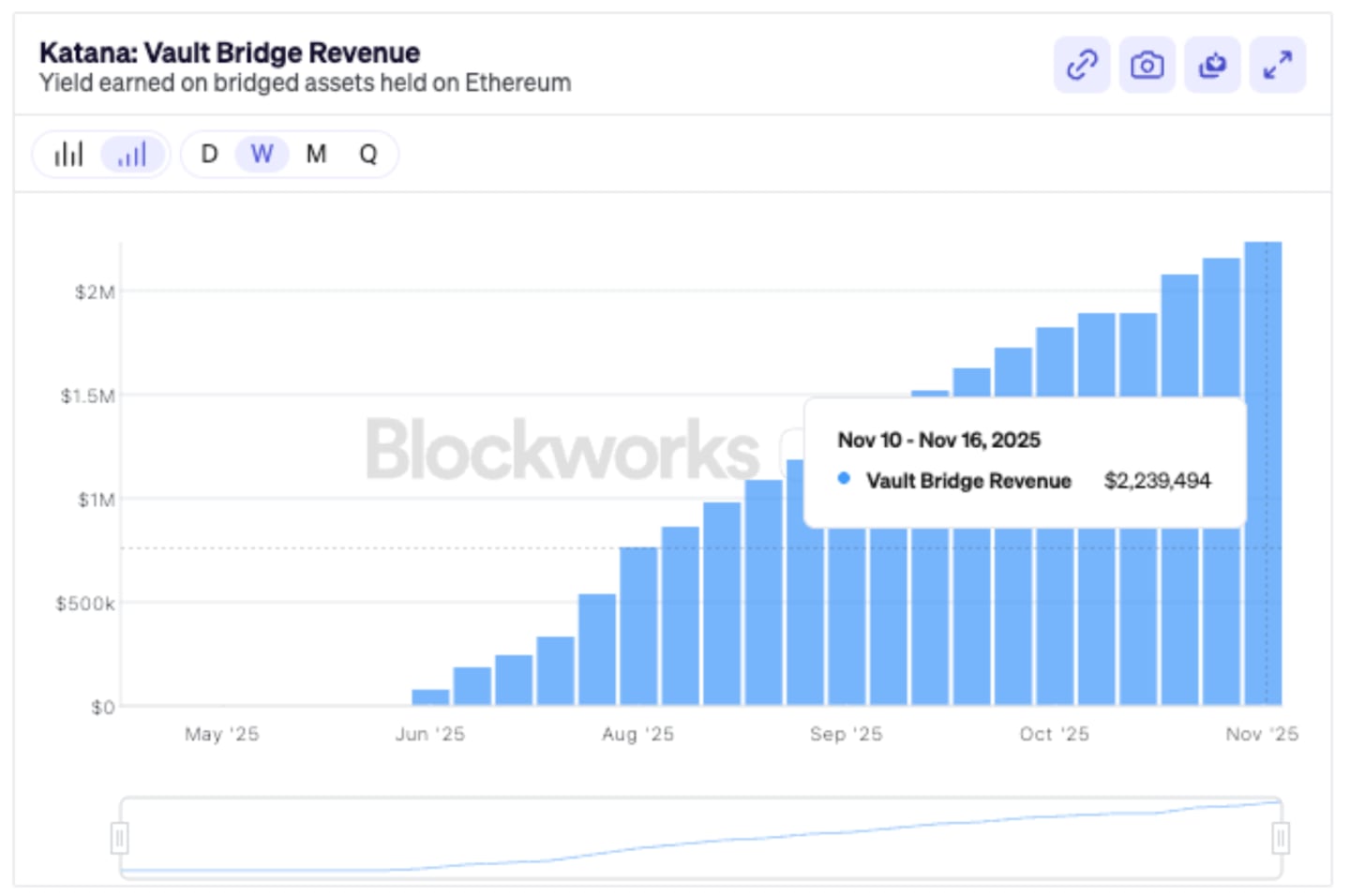

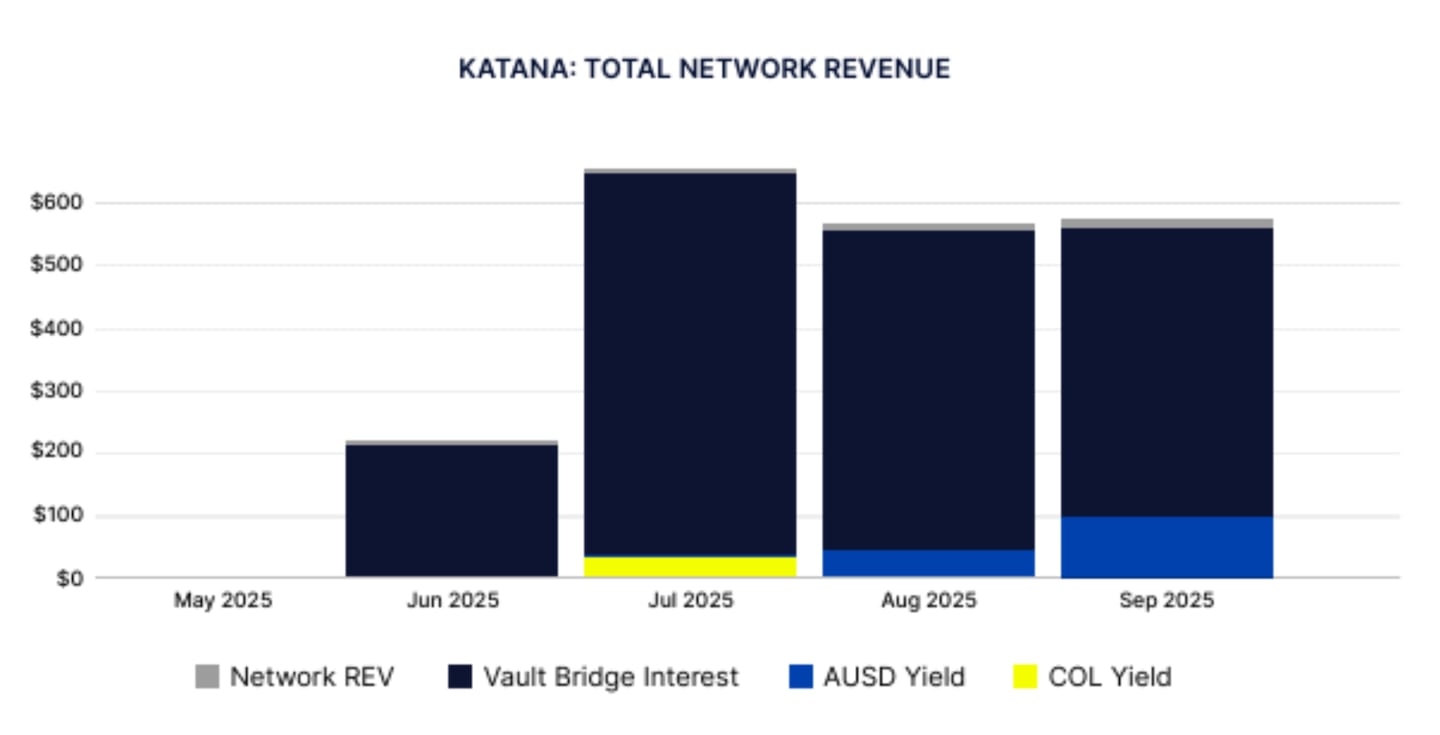

Since its deployment, VaultBridge has consistently channelled generated yield to the Katana Foundation to boost the yield for DeFi pools on Katana.

To date, VaultBridge has generated over $2M in revenue for Katana DeFi users participating in the liquidity mining programs.

Yield Distributions to Date: The Power of Passive Income

These real-world distributions prove the viability of the model and reinforce the DeFi flywheel:

September 5 Distribution: Over $150,000 in yield was distributed, boosting key markets like Morpho borrows and Sushi LPs. This distribution proved the mechanism was generating substantial, recurring income for the chain’s core markets, positioning this capital as permanent, passive income for the chain and its users.

September 19 Reinforcement: An additional $135,000 was distributed, reinforcing the same foundational markets. The consistent, multi-week funding proves the mechanism’s recurring power, unlike one-off grant programs typical of competing L2s.

October 1 Continuation: Another $88,000 was channelled into the rewards program, continuing the self-funded cycle that is tracked and reported retroactively. The continuous flow signals dependability and longevity to sophisticated capital providers.

October 14 Expansion: This distribution deployed over $63,000 in Vaultbridge yield to boost Morpho borrows, Sushi LPs, and newly integrated Spectra LPs. By enhancing APYs for USDC and WETH users and retroactively tracking rewards, the protocol demonstrated its ability to scale incentives across a growing ecosystem of partners while deepening liquidity for core assets.

October 28 Direct Value Injection: In a unique display of the flywheel’s power, over $45,000 in Vaultbridge and AUSD treasury yield was directly “donated” into Katana Yearn vaults. Rather than just a claimable reward, it instantly raised the value per vault share (yvvbTokens) for all holders. With injections across vbETH, vbUSDC, vbUSDT, and AUSD, this event proved that holding assets on Katana passively grows your net worth through real, hard-asset yield.

November 11 Scale: As Total Value Locked surged past $512M, this distribution of over $100,000 confirmed Katana as a major DeFi hub. The flywheel is now fully self-sustaining, generating massive real yield that scales directly with our rapid growth and cementing our position as the second-largest ZK rollup.

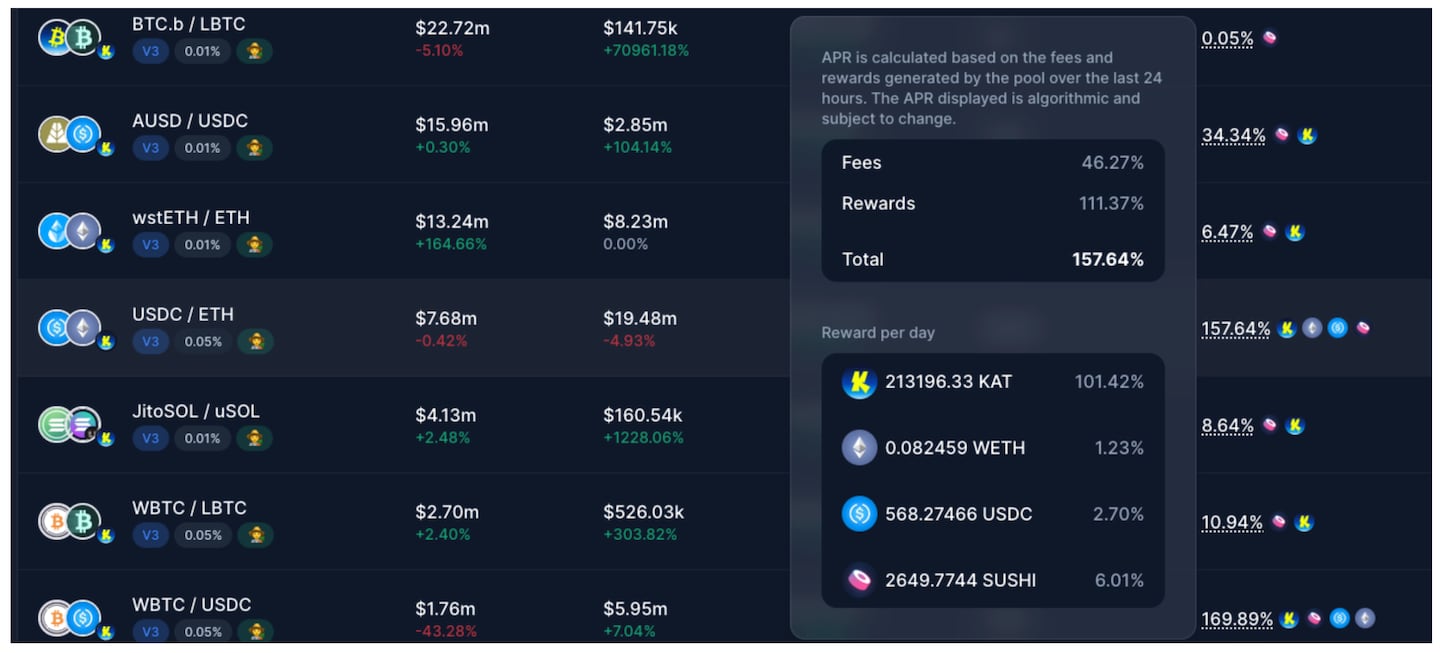

Active Productive Pools: Targeted Efficiency

The liquidity mining campaign operates on a two-week epoch basis, ensuring agility in targeting the long-term growth and health of the ecosystem. In the current epoch, real yield boosts are directed toward Morpho borrowers and suppliers, Sushi LPs, and Spectra LPs, with a focus on highly productive pairs:

- Morpho Markets: Focused on capital efficiency, incentivised pools include pairs like WETH/vbUSDC, vbWBTC/vbUSDC, yvvbUSDT/vbUSDC, and the Katana native stablecoin WETH/AUSD.

- Sushi Liquidity Pools: Critical for trading depth, pools like vbUSDC/WETH, vbWBTC/WETH, and AUSD/WETH receive ongoing yield injections.

- Spectra Liquidity Pools: Expanding the yield ecosystem to include Spectra LPs, ensuring a diverse and robust market structure.

This self-funding cycle, powered entirely by real VaultBridge yield, demonstrates a practical, sustainable alternative to traditional liquidity incentives.

Here is a breakdown to help you visualise the Katana Flywheel in action.

In this pool, LPs receive rewards from five distinct sources: native trading fees, KAT tokens, WETH, USDC, and SUSHI tokens.

The WETH and USDC rewards come directly from the yield generated by VaultBridge. This means you earn more ETH on your existing ETH and more USDC on your USDC, all in addition to the standard KAT and SUSHI incentives.

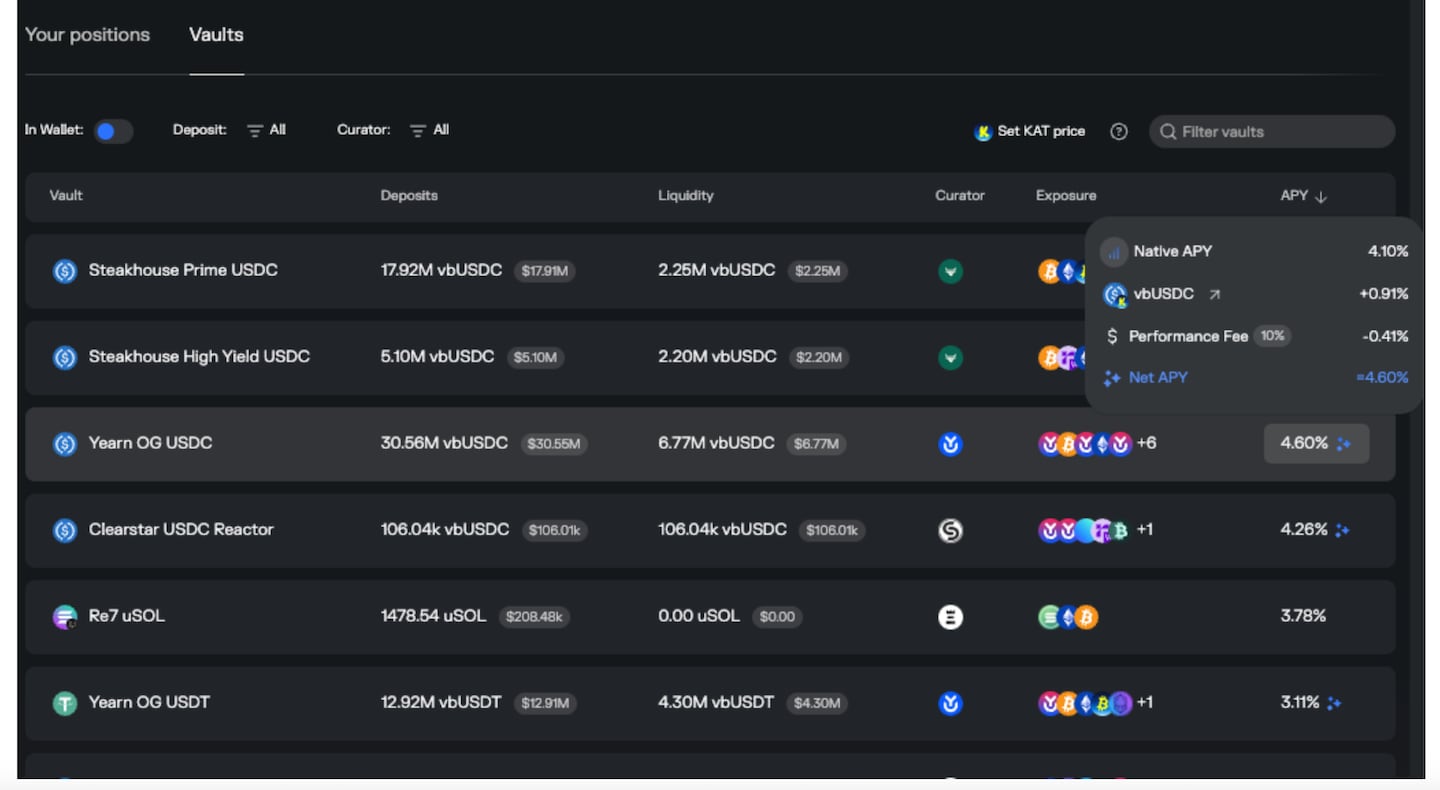

This example highlights the advantage for Morpho suppliers. You can see they are earning bonus USDC on deposits into select Morpho pools on Katana. VaultBridge generates this additional USDC and immediately redirects it as liquidity-mining incentives for suppliers. It is a live demonstration of the Katana Flywheel in action.

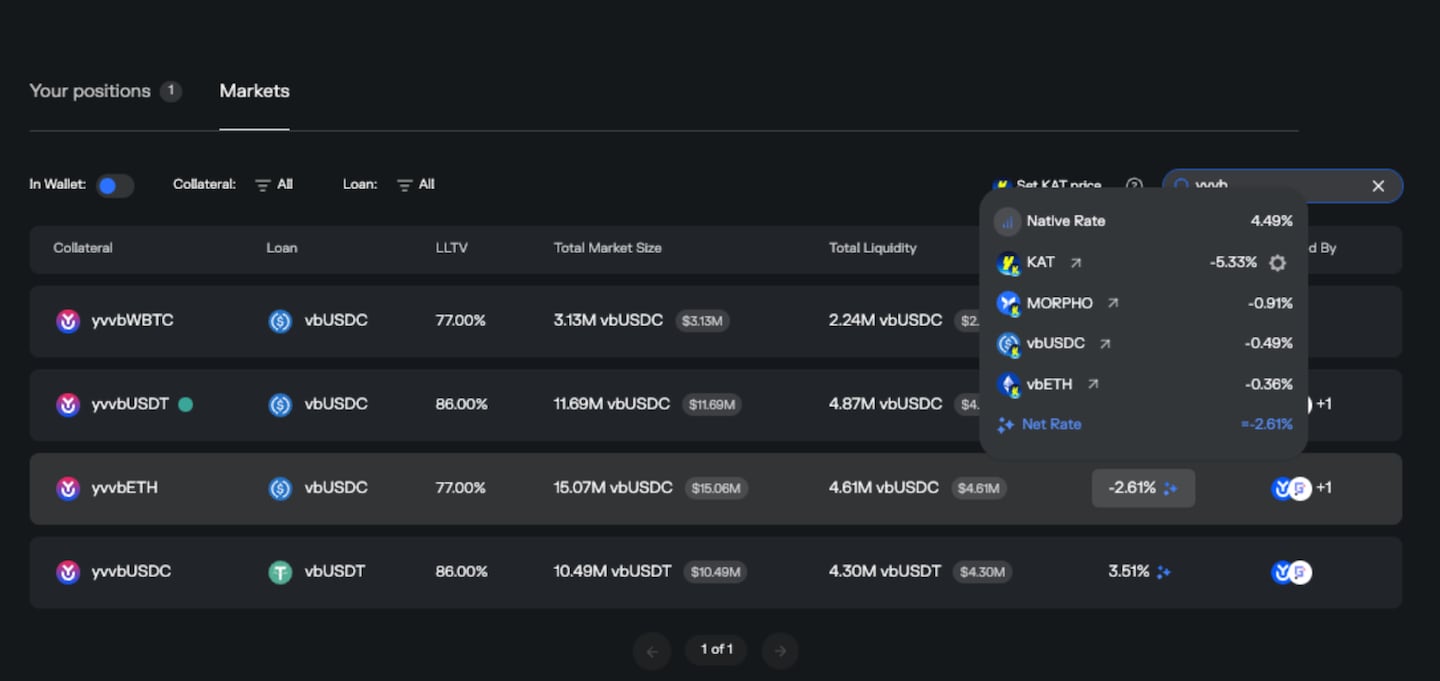

Finally, look at the Morpho borrower side. In select markets, you are effectively paid to borrow thanks to VaultBridge. While the native borrowing rate sits at 4.49%, the combined rewards from KAT, MORPHO, USDC, and ETH flip the equation, resulting in a net positive rate of 2.61% paid to you. This proves the model: as assets on Katana increase, the rewards for active DeFi users grow right along with them.

VaultBridge Donations

Beyond the continuous liquidity mining program, Katana periodically channels large VaultBridge yield donations directly into user vaults, raising the effective value of the underlying assets and immediately rewarding long-term vault token holders. Every donation actively reinforces the economic flywheel:

- August 26 Retroactive Reward: A combined distribution of $482,000 in VaultBridge yield and $27,000 in AUSD yield was distributed retroactively to user wallets. This large injection rewards past participation and boosts the base value of all existing yvvbToken positions.

- September 24 Capital Injection: A $200,000 donation combining VaultBridge and AUSD treasury yield was made, directly raising the value of yvvbToken positions.

These capital injections reward participation and recycle yield to organically grow the ecosystem, cementing Katana’s vision as a productive heartland for DeFi.

Donations into Yearn Vaults on Katana:

- Sept. 24th: $200,000

- October 3rd: $165,000

- October 13th: $80,000

- October 22nd: $67,000

- October 28th: $45,000

Risk, Oversight, and Ecosystem Integration

For such a large-scale, cross-chain mechanism, risk management and transparency are paramount. Katana ensures credibility through stringent oversight and defensive measures:

Prioritising Risk-Adjusted Returns: VaultBridge’s primary mandate is not to maximise APY but to generate transparent, consistent yield based on conservative financial principles. This strategy focuses exclusively on blue-chip crypto assets with deep liquidity on L1 and adheres to conservative Loan-to-Value (LTV) parameters when utilising lending protocols like Morpho.

- Custody and Interaction: Curators are purely advisory and do not hold or have custody of any user funds. VaultBridge interacts directly and non-custodially with audited third-party DeFi smart contracts (Morpho, Yearn).

- Risk Rating & Auditing: The underlying Morpho and Yearn vaults are continuously audited, while the specific yield strategies undergo rigorous due diligence by the curators to ensure they fit within conservative risk frameworks.

- Solvency and Buffers: The vbTokens are backed by a 1:1 solvency ratio with their underlying L1 assets. Liquidity buffers are maintained in protocols like Morpho to ensure smooth withdrawals and mitigate liquidity risks, making the bridge highly resilient.

VaultBridge is the central pillar of Katana’s integrated economic ecosystem:

- Agglayer’s Unified Bridge provides the fundamental infrastructure for trustless interoperability.

- Morpho delivers the yield generation upstream to the Katana Foundation to be used as incentives in key DeFi markets.

- Katana Core Apps (like Sushi and Morpho) serve as the distribution points for that yield.

- The Chain-Owned Liquidity (CoL) acts as a reserve layer for overall DeFi ecosystem stability.

- Sequencer Fees are routed back to either grow CoL or to boost rewards to active DeFi users.

- AUSD Treasury Yield - AUSD is backed by offchain US Treasuries, and that yield is routed back to the Katana Foundation to boost rewards for Katana DeFi users in core app DeFi pools.

The Future of Perpetual Reward

VaultBridge provides a compelling proof of concept: liquidity mining can sustain itself through real, verifiable yield. It transforms the necessary bridge reserves into a perpetual reward stream that strengthens Katana’s DeFi core and long term reduces the reliance on emitting KAT tokens for ecosystem growth.

The result is an L2 where every bridged asset, every liquidity pool, and every user contributes to a continuously self-funding ecosystem, positioning Katana not just as a scalable chain, but as the benchmark for a superior, sustainable economic model in DeFi.