- Regulatory pressure is spurring exchanges to delist or flag Monero and other privacy coins.

- A new low in liquidity is spurring Zcash and Firo to find a workaround.

- Issuers are hopeful they can reach an agreement with Binance.

Privacy coins are sinking.

Cryptocurrencies like Zcash and Monero are getting wrung out of the market as exchange after exchange moves to eliminate the assets from trading.

On January 5, crypto exchange OKX delisted several key privacy-centric trading pairs, stating they “do not fulfill our listing criteria.”

Last week, Binance added a so-called monitor tag to Monero, Zcash, Firo, and MobileCoin, suggesting it may also delist those tokens.

“Tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” the exchange wrote.

Reports on Reddit suggest that Binance’s lending program has already gone ahead and removed XMR from the list of available assets.

A quick scan of Binance confirms those reports. The exchange first added XMR as a collateral asset back in May 2022.

Spooked investors

Though the delisting isn’t official, it still spooked investors.

Zcash has fallen almost 19% in the last week, and Monero has stumbled almost 3%.

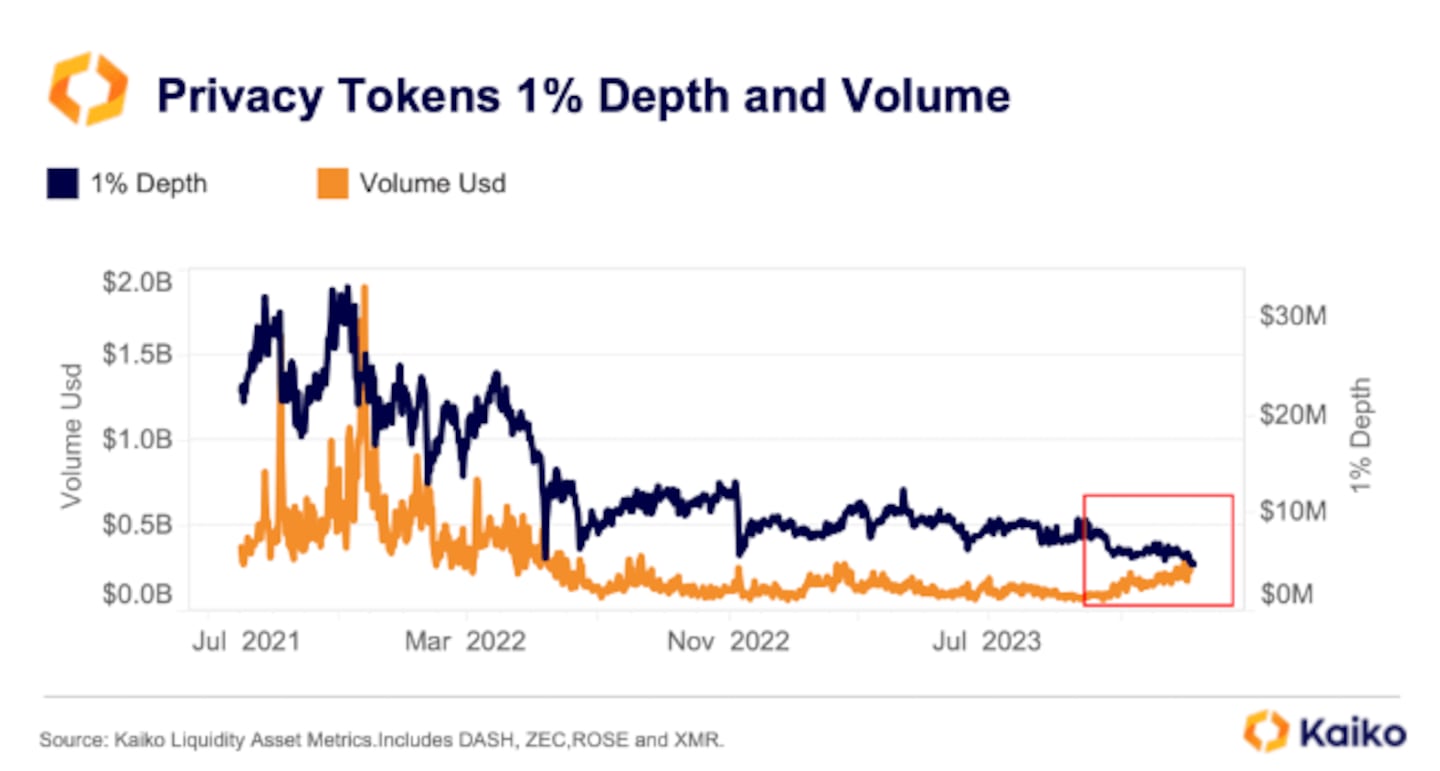

The liquidity for privacy coins such as Monero (XMR) and Zcash (ZEC) has sunk to an all-time low, according to new data from analysts at Kaiko.

“Most businesses will not want to interact with privacy coins given their negative connotations,” Clara Medalie, Kaiko’s director of research, told DL News.

“Many exchanges are delisting privacy coins, which suggests that market makers don’t want to provide liquidity for them.”

Privacy coins can obfuscate users’ identities by hiding sender details and transaction history.

This makes them notoriously difficult to track, drawing scrutiny from regulators worldwide.

A core feature of the original crypto ethos, privacy coins also continue to command many investors’ attention. Monero and Zcash boast a combined market capitalization of $3.48 billion.

This position now appears to be at serious risk, experts say.

Serious challenge

With $15 billion in daily trading volume, Binance’s dominance makes its action a serious challenge to the fortunes of these projects.

Binance doesn’t have much of a choice. After pleading guilty in November to violating US banking law and paying a $4 billion penalty, it’s required to implement stronger anti-money laundering and know-your-customer controls.

‘Binance was clear from the beginning that if we did not create an exchange-only address type, they would delist ZEC.’

— Jason McGee

Moreover, in negotiations over the EU’s Anti-Money Laundering Regulation, lawmakers are discussing whether to ban privacy coins like Monero and Zcash.

Fight is on

Now, the fight’s on to keep Binance from axing privacy coins altogether.

Some projects have devised a novel workaround to try and get the nod from Binance.

Others, such as Monero, refuse to comply with Binance’s requests, with members of its community lashing out against the exchange in December. A Monero representative did not reply to a request for comment.

All-seeing crypto addresses

The workaround others are trying is called an “exchange-only” crypto address.

The idea is that users looking to move funds to an exchange would whip up a new transparent address, send private funds to this address, and then send those funds to the exchange-only address.

First proposed by the privacy project Firo last November – which is also on Binance’s chopping block – an exchange-only address can only receive funds from transparent addresses rather than their private, or so-called shielded, counterparts.

“They don’t want to receive shielded transactions,” Jason McGee, a committee member for Zcash Community Grants and the project’s Binance liaison, told DL News.

“Binance was clear from the beginning (early November) that if we did not create an exchange-only address type, they would delist ZEC.”

‘Binance doesn’t want to touch any funds from sources that have an unidentified send.’

— Reuben Yap

Firo project steward Reuben Yap told DL News that Binance initially asked the project to remove all its privacy features. He said it couldn’t.

Binance is still mulling the proposed solution, say McGee and Yap. They are hopeful it will be accepted because it would let the exchange show regulators the history of a depositing address.

“Binance doesn’t want to touch any funds from sources that have an unidentified send,” Yap said.

Binance did not immediately respond to DL News’ request for comment.

Justin Ehrenhofer, the founder of a crypto sleuthing firm focused on difficult-to-trace transactions Moonstone Research, told DL News the Monero community wasn’t considering the exchange-only approach.

Lots of discussion

In any event, the idea is generating some buzz.

“There has been a tremendous amount of discussion about this within the Zcash community,” Zooko Wilcox-O’Hearn, the CEO of Electric Coin Company, the firm developing Zcash, told DL News.

Yap told DL News that the exchange address solution is expected to launch in two weeks.

As to what Binance will do at that point, it’s anyone’s guess.

Liam Kelly is a Berlin-based DeFi Correspondent. Contact him at liam@dlnews.com or on Telegram at @Liam_Gallas.