A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Axie Infinity’s Ronin blockchain is making a comeback

- A new liquid restaking protocol wants to ‘vampire attack’ Lido

- The Curve team is gearing up for another big launch

Ronin trading volume and TVL soar

On March 23, 2022, the bridge connecting the Ronin blockchain to Ethereum was hacked for $624 million, the biggest onchain crypto hack ever.

The situation looked bleak. In addition to the huge loss, user activity on Axie Infinity, the Ronin Blockchain’s flagship game, plummeted.

Fast-forward two years, and despite the odds, Ronin is thriving again. On Monday, Binance listed the blockchain’s RON token for trading after a 74% rally since the start of the year.

Ronin is a so-called layer 1 blockchain. It was originally launched as a low-cost alternative to Ethereum.

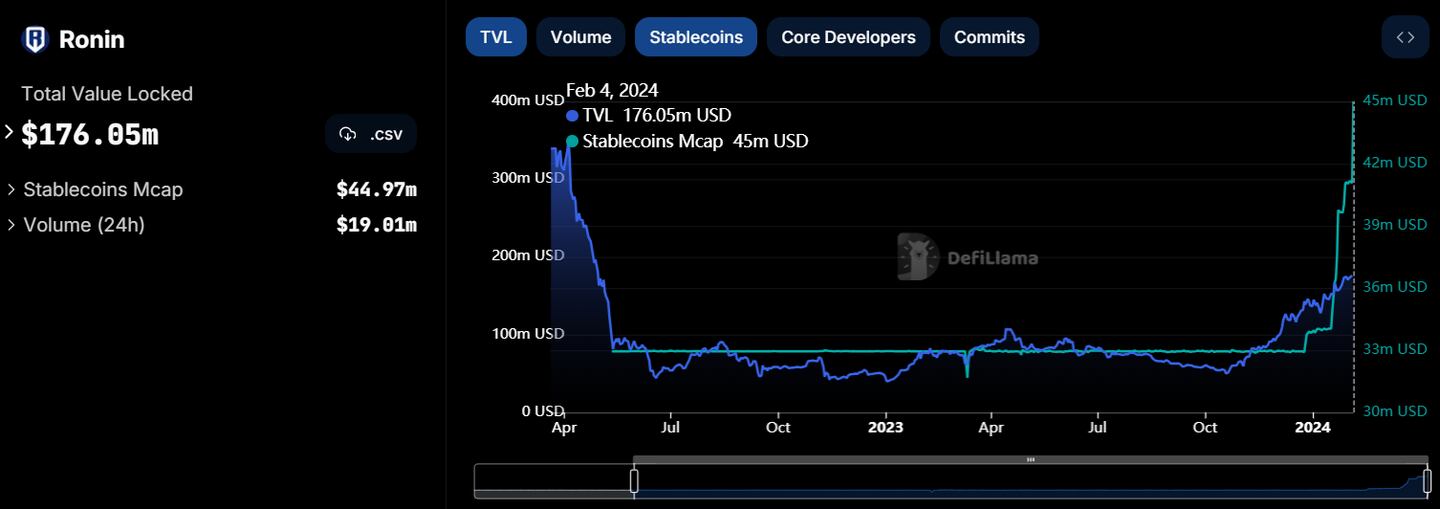

In recent months, activity on Ronin has spiked. Trading volume on the blockchain is up 54% this week, while total value locked — a measure of funds locked in protocols on Ronin — jumped 28% this month.

Games such as Pixels have brought a new wave of users to Ronin, while existing projects — like early NFT franchise Cyberkongz — are planning to migrate to Ronin.

Ronin’s recent success could be a bellwether for a wider resurgence in crypto gaming, following its boom and bust during the previous bull market.

Puffer Finance wants Lido’s blood

Puffer Finance, a new entrant to the nascent liquid restaking sector, has drawn in over $440 million in deposits in less than a week.

Puffer isn’t just competing against rival liquid restaking protocols like Kelp DAO and ether.fi — it wants to take on Lido, the biggest liquid staking protocol with more than $21 billion of deposits.

It plans to conduct what’s known in DeFi circles as a vampire attack — a type of aggressive growth strategy where a protocol targets users of a rival protocol by offering additional incentives.

Puffer requires users to lock up Lido’s stETH to mint its restaking token called pufETH. Once the protocol fully launches later this year, Puffer will convert the stETH tokens backing pufETH into Ether and restake them itself in permissionless validators.

If successful, the plan should help chip away at Lido’s market dominance — a hot issue within the Ethereum community.

Curve isolated lending is coming

The team behind decentralised exchange Curve Finance and the crvUSD stablecoin is about to launch its own lending market.

Dubbed Llamalend by the Curve community, the new protocol will allow users to borrow and lend using any Ethereum-based crypto as collateral. It uses the LLAMMA soft liquidation mechanism outlined in Curve co-founder Michael Egorov’s crvUSD whitepaper.

This means that instead of loans hitting an all or nothing liquidation threshold — as they do on other lending markets such as Aave — Llamalend will liquidate delinquent positions gradually. The algorithm can even buy back sold collateral if prices recover.

Egorov told DL News that he tentatively expects Llamalend to launch by the end of the week.

(Full disclosure, DL News’ founders were core contributors to the Curve protocol.)

Data of the week

The Ronin blockchain’s TVL has increased 250% over the past three months. And since the start of the year, the number of stablecoins on Ronin has also jumped 36%.

The fact that users are depositing stablecoins to Ronin is important. It shows that the TVL increase isn’t just due to the price increases of tokens already on Ronin, and that users are depositing new funds to the blockchain.

This week in DeFi governance

TEMP CHECK: Uniswap set to greenlight deployment on Zora

VOTE: Frax makes more progress toward onchain US Treasury bills

VOTE: Arbitrum DAO wants to diversify its holdings with real-world assets

Post of the week

Memecoins broke through into the real world this week after someone adorned the iconic raging bull statue near Wall Street with a pink crocheted hat — a nod to Solana memecoin dogwifhat.

It’s not the first time memecoin investors have pulled a similar stunt. In 2021, pictures of the giant brass bull facing off against a Shiba Inu went viral in appreciation of Dogecoin.

Yes this is real pic.twitter.com/oAKRJv2H1J

— OJC 💫 𓃓 (@OjCrypto) February 2, 2024

What we’re watching

I'm excited to share our latest research on adjusting the block gas limit.

— Toni Wahrstätter ⟠ (@nero_eth) February 5, 2024

Together with @VitalikButerin, we're exploring paths to reduce the maximum block size, balance calldata pricing, and ultimately raise the block gas limit.https://t.co/Thvyw9Yog3

Ethereum Foundation researcher Toni Wahrstätter and Ethereum co-founder Vitalik Buterin have co-authored a proposal to increase the block gas limit and the price for nonzero calldata bytes.

Doing so, they argue, should reduce block sizes and incentivise the transition to using blobs for data availability.

Got a tip about DeFi? Reach out at tim@dlnews.com.