- Ether held on exchanges has plummeted since mid-April.

- Meanwhile, a “massive amount of Ether” has been staked, accelerated by the Shapella upgrade in mid-April.

- Much of the Ether that left exchanges likely went toward staking, a change that could augur a boost for DeFi.

Ether investors have found a new favourite place to park the world’s second-largest cryptocurrency.

On Monday, Ether staked by investors reached almost $44 billion, leapfrogging the amount held by centralised exchanges including Coinbase and Binance, according to data from Nansen.

Ether held on centralised exchanges has been sinking since April. Investor flight accelerated this month amid the Securities and Exchange Commission’s lawsuits against the two crypto exchange giants.

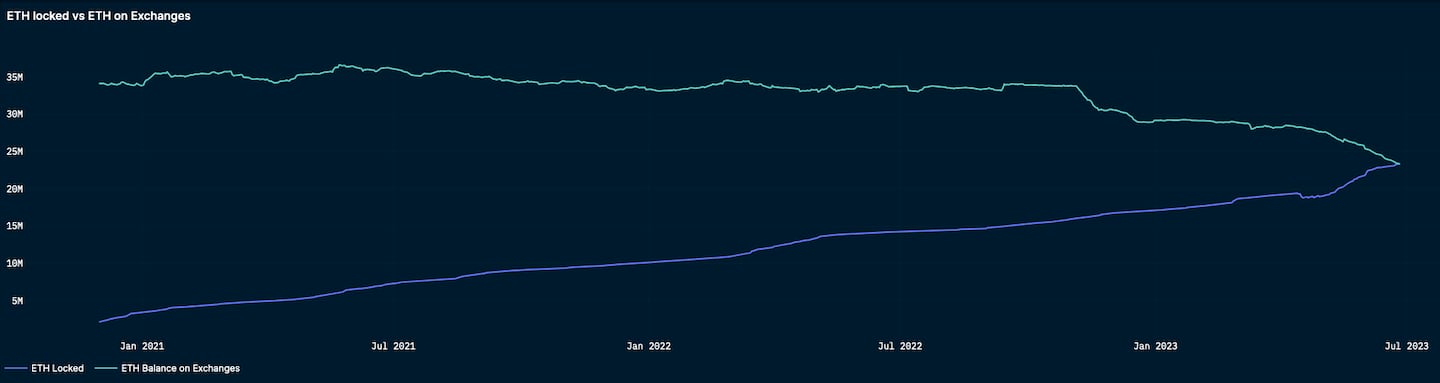

At the same time, investors have flocked to stake their Ether, encouraged by a major network upgrade in mid-April. Since Ethereum’s Shapella upgrade, the amount of Ether held by exchanges has fallen by about 5 million to 23 million, according to data from Nansen.

In that same span, the amount of “staked” Ether has increased by about 4 million, a surge that has surprised observers.

“If pre-Shapella someone had said … [ETH staking] was just going to go parabolic, you would have been like, ‘you’re huffing glue, you’re an ETH maxi,’” Mike Silagadze, the co-founder of staking firm Ether.fi, told DL News.

While the exact destination of the crypto leaving exchanges is difficult to track, much of it has probably been pulled in order to stake, according to analysts who spoke to DL News.

The shift could benefit the nascent DeFi ecosystem. Still, that will depend in large part on whether retail and institutional investors have become comfortable enough with on-chain finance.

‘A massive amount of Ether’

Staking is the process of securing the Ethereum blockchain by locking up Ether. Users who do so earn a modest annual reward, currently about 4%. Until April, however, it was not possible to withdraw Ether once it had been staked. The Shapella upgrade enabled withdrawals, removing a measure of uncertainty that kept many would-be stakers on the sidelines.

Since Shapella, deposits to stake Ether have surged, with liquid staking protocols Lido, Rocket Pool and Frax the main beneficiaries. For network stability, Ethereum limits the amount of Ether that can be staked or withdrawn in a given time frame; roughly 50,000 Ether can be staked each day, and the wait list is now several weeks long.

“Just from sheer volume, that’s a massive amount of Ether. That’s almost $100 million in Ether a day,” Silagadze said. “It’s not like people are sitting there with hundreds of millions of dollars of ETH in self-custody.”

Some of the Ether that “left” has in fact been staked by those exchanges, said Nansen analyst Martin Lee. Centralised exchanges have long offered the average user a relatively hassle-free way to stake their Ethereum.

NOW READ: ‘I expect this to move quickly:’ New UK crypto laws could be in place by autumn

But even that option has taken a hit. The SEC forced Kraken to end its staking business in the US. And Coinbase’s liquid staking token cbETH has declined in total value locked, from $2.5 billion to less than $2 billion, since staking withdrawals were enabled, according to data from DefiLlama.

Liquid staking tokens such as cbETH are placeholder tokens representing staked Ether. Their market capitalisation is a proxy for the popularity of a given liquid staking protocol.

Boris Wertz, partner at VersionOne Ventures, plans to move his firm’s staked Ether with a value in the “low millions” from Coinbase to liquid staking protocol Ether.fi. His firm is an investor in both companies.

“There’s a preferred solution for every user. I don’t think you’re suddenly going to see centralised exchanges go away on the exchange side or the staking side,” Wertz said.

But as companies and protocols rush to meet the boom in staking, institutional investors are finding options outside traditional players like Coinbase.

“Where’s that equilibrium between centralised and decentralised staking solutions?” Wertz said. “I think in a few months, probably we’ll know what the new status quo will be.”

If pre-Shapella, someone had said ETH staking was going to go parabolic, you would have been like, ‘you’re huffing glue, you’re an ETH maxi.’

— Mike Silagadze

A boon for DeFi?

To be sure, there are other factors driving the decline in Ether on exchanges.

In its lawsuit, the SEC alleged Coinbase is operating an unlawful exchange and permitting investors to trade in unregistered securities. Binance, meanwhile, has been accused of illegally allowing Americans to trade on its platform. A long decline in stablecoin liquidity suggests that some people are simply exiting crypto altogether. And large institutional players have been slowly moving their crypto from exchanges to self-custody, Lee said.

“A lot of large institutions historically would kind of treat exchanges as something like a custodian as well,” he said. “But I would say now we’re seeing … large institutions kind of diversifying custodial solutions and using other types of solutions such as Fireblocks or MetaMask institutional.”

Since a mid-April high, Ether on Coinbase has declined by about $4 billion, to $14.3 billion. Ether on Coinbase custody has declined from $5.4 billion to $3.6 billion. And Ether on Binance has declined by more than $2 billion, to $8.6 billion.

Taken together, the various forces that have sapped the amount of Ether held on exchanges may augur a boost for the decentralised finance economy.

“I would hope for us to see a more vibrant DeFi economy,” Lee said.

Still, that’s not a given, according to Matt Leisinger, co-founder of Alluvial, a company building a liquid staking protocol geared toward institutional investors. Most of the staking is being done by liquid staking protocols that provide users with derivative tokens redeemable for their locked Ether, such as Lido’s stETH and Rocket Pool’s rETH.

NOW READ: Do Kwon’s new home: an overcrowded Balkan prison with mafia suspects and little hope

“It’s a matter of where those will be traded now,” Leisinger said. “It depends on the customer segment, but it could be centralised platforms or DEXes.”

And if investors are content to just move their Ether to an alternative custodian, the decline in Ether held on exchanges will have little impact elsewhere, Lee said.