- BlackRock CEO Larry Fink said a spot Ether ETF is still possible if the SEC deems it to be a security.

- The SEC is reportedly determined to bring the second-largest cryptocurrency under its purview.

- Fink said he’s bullish on BlackRock's spot Bitcoin ETF, which has quickly become the fastest-growing ETF ever.

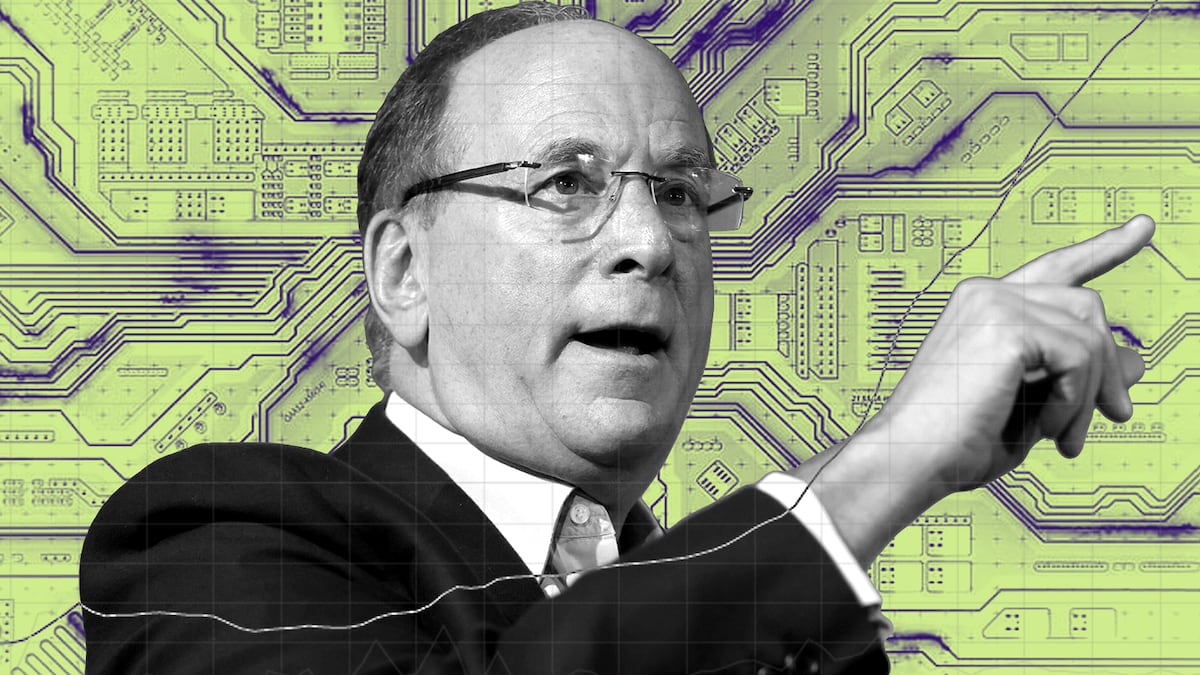

BlackRock CEO Larry Fink said Wednesday his company could potentially create a spot Ether exchange-traded fund, even if the US Securities and Exchange Commission classifies Ether as a security.

BlackRock is one of several ETF providers that applied with the SEC for a spot Ether ETF, but some have expressed doubts that the agency will approve the ETFs by a May deadline.

Fink told Fox Business’ Charlie Gasparino he couldn’t discuss too much when Gasparino asked if the SEC might designate Ether as a security.

“But I don’t think that designation is going to be too deleterious,” Fink said, suggesting that a potential security designation wouldn’t prevent the creation of spot Ether ETFs.

Last week, Fortune magazine reported that the SEC subpoenaed three companies regarding information about the Ethereum Foundation, the Swiss-based nonprofit that contributes to the Ethereum blockchain’s growth and development. The article highlighted the agency’s potential aim to designate Ether as a security, as opposed to Bitcoin, which is classified as a commodity.

If the SEC labels Ether a security, it might use the designation as an excuse to delay or deny a spot Ether ETF, crypto attorney Gabriel Shapiro told DL News earlier this month, It is “likely their biggest objective,” Shapiro said.

Bitcoin ETFs

On Fox Business, Fink said he is “very bullish on the long-term viability of Bitcoin.” BlackRock’s iShares Bitcoin Trust ETF has amassed $17 billion in assets under management since the ETF was approved on January 10 to become the fastest-growing ETF ever.

“I’m pleasantly surprised, and would have never predicted it before we filed it that we were gonna see this type of retail demand,” Fink said.

Tyler Pearson is a markets correspondent at DL News. He is based out of Alberta, Canada. Got a tip? Reach out at ty@dlnews.com.