- Circle’s USDC stablecoin has a total market capitalisation of about $26 billion, down over 40% since the beginning of the year.

- Tether continues to dominate the stablecoin market, registering nearly $1 billion in excess reserves last quarter, in its latest attestation.

Five months have passed since the collapse of Silicon Valley Bank spooked Circle investors and spurred billions in withdrawals. It doesn’t look like they’re coming back anytime soon.

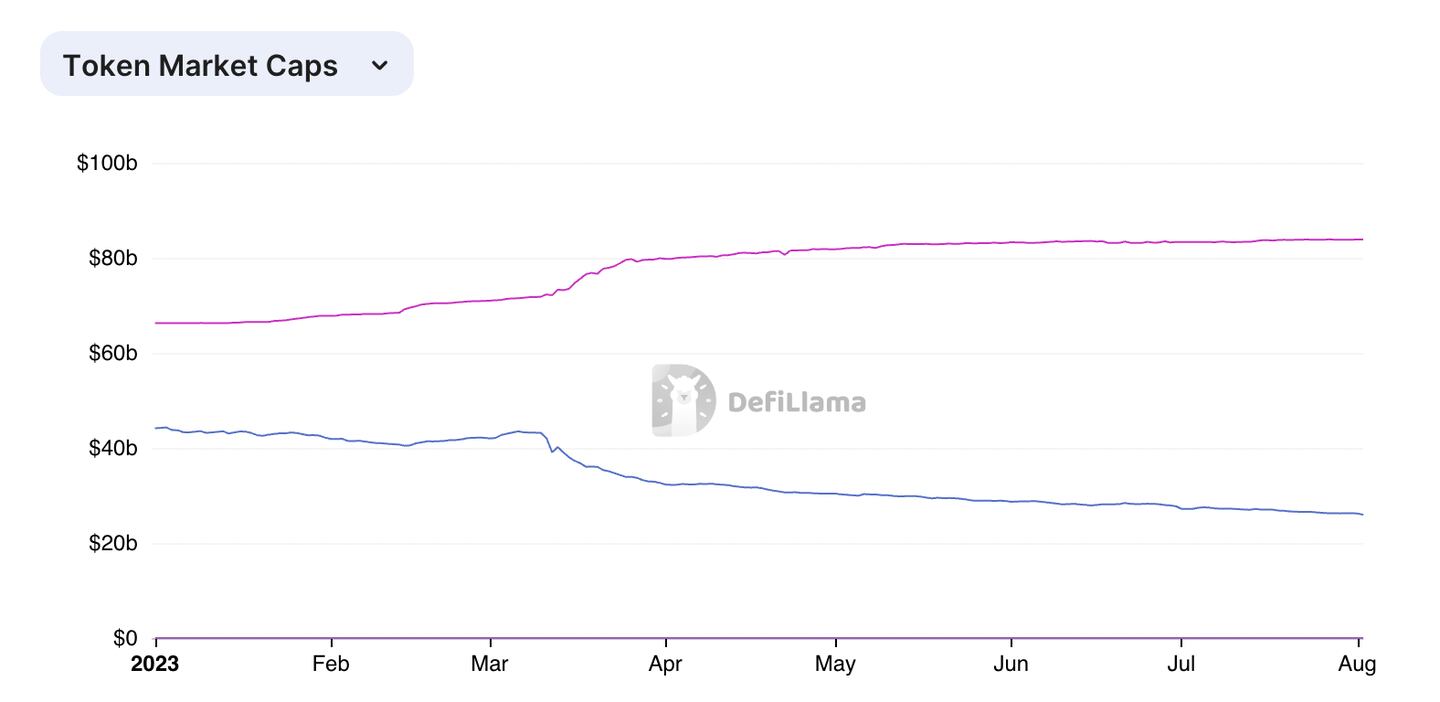

This year, the market capitalisation for Circle’s USDC stablecoin has plummeted 41% to below $26 billion, compared to a 25% surge in the value of USDT, the stablecoin issued by archrival Tether, according to DefiLlama data.

Tether’s $84 billion market cap is now three times greater than Circle’s, which has sunk to its lowest level since late June 2021.

Tense hours

Circle’s woes can be traced to the collapse of SVB in March and the token issuer’s delayed response to speculation over reserves it uses to support USDC.

The crypto firm delayed giving an answer on whether it held reserves to support its stablecoin at the bank, with Tether and Paxos both releasing statements earlier. The tense hours triggered fears it may become decidedly unstable.

NOW READ: Curve Finance woes and BALD drama on Base dominate DeFi news week

After Circle confirmed it held $3.3 billion at SVB, the stablecoin slipped its peg and fell to 86 cents, according to a Chainalaysis report.

Circle suffered a record $4.5 billion in withdrawals in during the episode, according to Arkham Intelligence data.

Circle’s stablecoin rebounded after the weekend to $1 following interventions from federal and state regulators to guarantee SVB’s deposits and backstop regional banks. But the stablecoin’s market cap has been falling steadily month-on-month ever since.

Meanwhile, Tether’s market cap jumped by around $9 billion in March, suggesting investors were swapping USDC for USDT.

Now read: A new agency that aims to be the Moody’s of stablecoins just gave Tether a D rating

The damage wrought by Circle’s links with SVB is a stark demonstration of how investors can lose trust in token issuers, even one that is known as a steady performer in the markets.

Led by CEO Jeremy Allaire, a well-regarded entrepreneur and influential voice in the crypto community, Circle has sidestepped questions about its reserves that have long plagued Tether.

But the banking crisis in March, coupled with the regulatory crackdown led by the US Securities and Exchange Commission in the wake of FTX’s crash in November, has turned up the pressure on all blue-chip crypto platforms.

And as the data shows, Circle is finding it hard to win back investors.

Circle didn’t immediately respond to a request for comment from DL News.

Tether turns a profit

Meanwhile, Tether, which has long drawn scrutiny for its reserves policies, released its latest “attestation,” or financial report card, on Monday.

Tether saw its excess reserves increase by $850 million, lifting its total to $3.3 billion. These are the firm’s “own profits,” which are not distributed to shareholders and which the company keeps “on top of the 100% reserves,” it says it maintains to back its stablecoin.

Tether’s profits are derived from transaction fees and earnings on investments, such as US Treasury bills. As of June 30, the firm held nearly $56 billion in three-month bills. At the current rate of 5.28% the stablecoin issuer could clear nearly $3 billion in interest earnings on these.

Now read: ‘Tether is next’ says short seller who bet against Silvergate and Signature Bank

The quarterly attestations, carried out by BDO Italia, are essentially a disclosure of the firm’s accounts and reserves on a certain date. Tether has consistently said its attestations are proof the stablecoin is fully backed by reserves they are limited in scope.

For instance, BDO Italia, notes the attestation is limited to a “point in time as of 30 June 2023,” and it did not provide any assurances at any other time.

Three lawsuits

“Activity prior to and after this time and date was not considered when testing the balances and information described above,” BDO Italia notes, adding, “We have not performed any procedures or provided any level of assurance on the financial or non-financial activity on dates or times other than that noted within this report.”

Despite the increasing market cap and profits, Tether does face challenges. The firm and its wholly-owned subsidiaries are defendants in three ongoing civil lawsuits. The report provided no additional details on the legal cases.

Have a tip on Circle or Tether? Contact Adam by email at adam@dlnews.com or by Telegram at adammac95.