- At least seven crypto treasury firms are doing share buybacks as stock prices slump.

- Analysts warn valuations are diverging from token holdings, raising questions over the model.

Bad signs are coming hard and fast for crypto treasury companies.

At least seven firms — from electric golf cart makers to biotech minnows — piled into Bitcoin and Ethereum only months ago, holding the digital assets on their corporate balance sheets.

Yet now, they are already borrowing cash to fund stock buybacks, Financial Times reported.

“It’s probably the death rattle for a few [of these companies,]” Adam Morgan McCarthy, senior research analyst at crypto analytics company Kaiko, told the Financial Times.

The turn to buybacks marks the latest sign that the crypto treasury boom is faltering as investors question whether the model of listed companies holding tokens on their balance sheets can last.

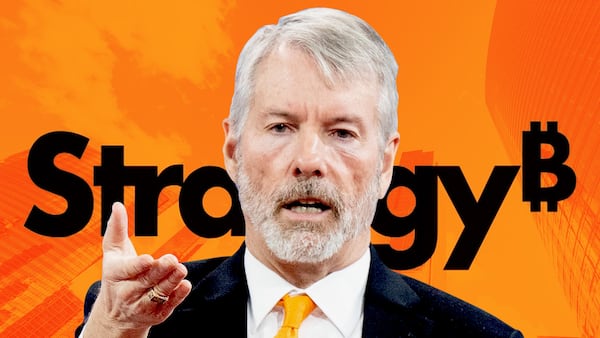

More than 200 companies worldwide now hold Bitcoin or other crypto tokens after adopting the so-called “Saylor trade,” named after Michael Saylor.

Those companies essentially aim to copy how his company, Strategy, has transformed itself from being a software venture into a $100 billion Bitcoin-buying juggernaut,

But the cracks are deepening.

One in three listed treasury firms trade below the value of the crypto they own, according to Capriole Investments, undercutting the very logic of the strategy. If they trade below the underlying asset, then those firms can’t issue new stocks to pay debt and buy new tokens, thus failing to drive Sayloresque-sized profits.

Some, like former Republican presidential candidate Vivek Ramaswamy’s Strive Asset Management, have responded to the loss of momentum by taking the opportunity to gobble up smaller struggling firms. In Strive’s case, that meant acquiring fellow Bitcoin hoarder Semler Scientific.

Elsewhere, crypto treasury companies are devaluing their stock in a form of financial ninjutsu designed to keep them trading on stock exchanges.

“We’re starting to see digital asset company stock prices diverge from the underlying crypto prices, which is making investors question whether they are a worthwhile investment,” Dom Kwok, former Goldman Sachs analyst, recently told DL News.

Buybacks

Several companies are now positioning defensively by issuing buybacks.

ETHZilla, a biotech firm that rebranded and bought $460 million worth of Ethereum, has seen its stock collapse 76% since August. Last week it borrowed $80 million against its crypto holdings to fund a $250 million share buyback, Financial Times reported.

And others are following suit.

Empery Digital, a Texas vehicle maker that pivoted to Bitcoin in July, has raised $85 million in fresh debt to buy back stock.

CEA Industries, which bought Binance’s BNB token with backing from Changpeng Zhao’s family office, is preparing a $250 million repurchase after its shares gave up ninefold gains.

SharpLink Gaming and Ton Strategy have also unveiled billion-dollar buybacks, while Japan’s Metaplanet says it may join if its valuation slips further.

Crypto market movers

- Bitcoin is up 0.4% over the past 24 hours to trade at $113,206.

- Ethereum is up 0.1% over the past 24 hours trading at $4,211.

What we’re reading

- Philip Hammond’s crypto firm Copper reports $40m UK loss — Financial News

- Stablecoin startups raise record amounts as total supply seen to hit $1tn— DL News

- Scattered Spider Crypto.com Breach Exposed Users’ Personal Data: Report — Unchained

- 5 tokens absorbing crazy revenues — Milk Road

- Market structure bill risks creating an ‘illicit finance superhighway’ for DeFi, warns expert— DL News

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.