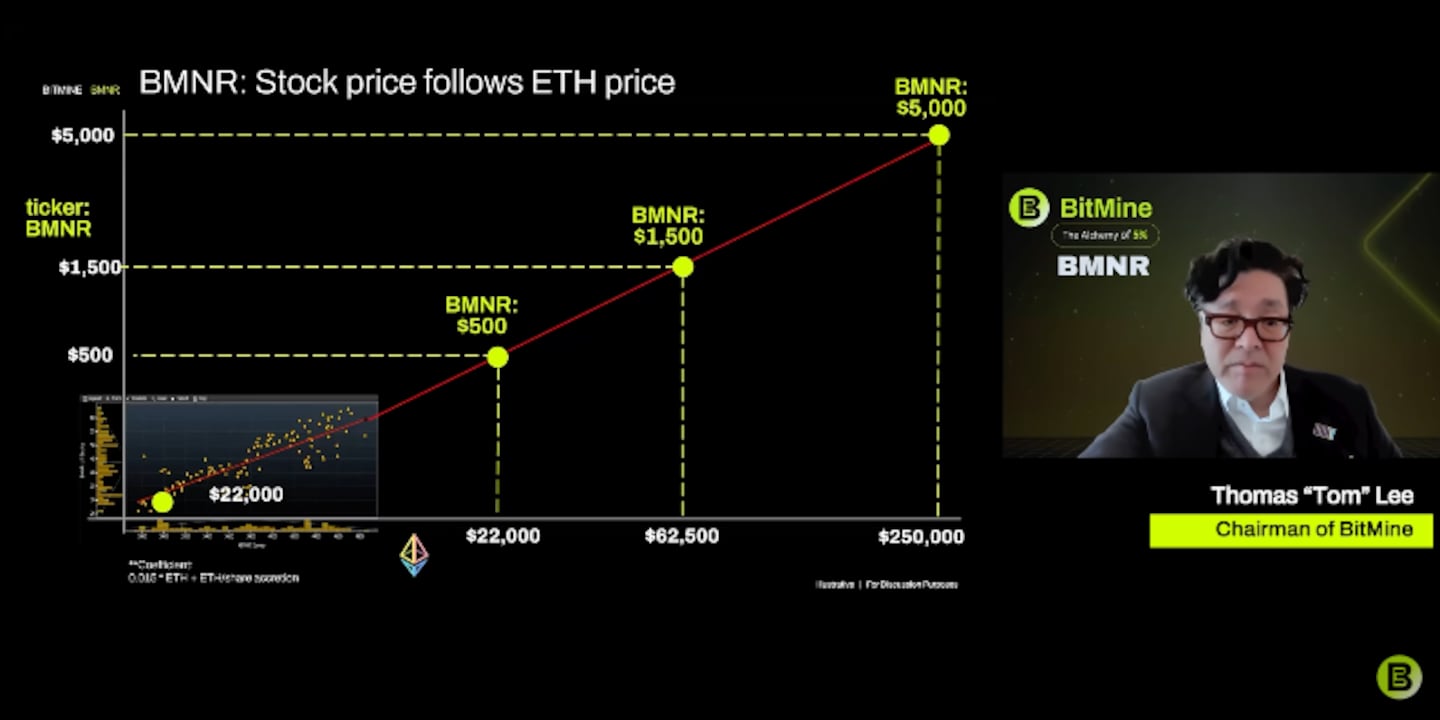

- Lee makes his boldest call yet, targeting $250,000 Ethereum and $5,000 Bitmine share price.

- Bitmine shares jump 15% after stock split proposal. Shareholders urged to vote by January 14.

Ethereum’s price will surge 8,000% and trade at $250,000 per token, according to Bitmine chairman Tom Lee.

That surge would catapult the value of the second-largest crypto to about $30 trillion — more than Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla combined.

In a message to Bitmine shareholders, Lee cites the six-figure target while proposing an increase in the company’s authorised shares to grow 100-fold from 500 million to 50 billion in order to set the stage for a future stock split. He urges shareholders to vote by January 14.

Bitmine’s share price jumped 15% after Lee’s proposal. This signalled investor confidence in the company and support for the strategy, which also includes “opportunistic acquisitions” and capital markets plays including “convertibles and warrants.”

DAT woes

The confidence bump comes as digital asset treasury firms like Bitmine is under pressure due to the crypto market having shaved roughly $1 trillion of its value since October.

This means that many of the public firms that have pivoted into becoming DATs are trading at lower values than their underlying assets, putting the viability of their business models into question.

This marks a dramatic change from the beginning of 2025 when a wave of companies pivoted into becoming DATs, spurred on by the Trump administration support of the crypto industry.

“The initial hype is over,” Brian Huang, co-founder of investment platform Glider, told DL News earlier in January.

Ethereum to $250,000 wen?

Lee’s bold call comes as Ethereum trades just above $3,100. That’s less than half of Lee’s prediction that the crypto’s price would hit $7,500 by the end of 2025.

In recent weeks, Bitmine purchased $1.4 billion more of the crypto, bringing the firm’s Ethereum holdings to over $12 billion.

Publicly-traded companies perform stock splits to lower the price of a single share. That will make it seem more affordable for regular investors to buy in without changing the company’s actual total value.

By increasing the number of shares available at a lower price, the company also makes its stock easier to trade on the market.

Backed by top institutional investors — including Peter Thiel’s Founders Fund and Cathie Wood’s ARK Invest — Bitmine now owns over 3.4% of Ethereum’s circulating supply and is aiming for 5%.

Lee argues that a stock split will be necessary because Bitmine’s “stock price follows Ethereum price,” and projects the company’s stock trading at $5,000 per share when Ethereum reaches $250,000.

He did not offer a timeframe for any of his targets.

To be sure, Lee is far from the only one with grand plans for Ethereum.

Vitalik Buterin, the blockchain network’s co-founder, described the technology as “civilisational infrastructure” on the first day of 2026.

Commenting on the development of new ZKEVM technology, Buterin said “they are shifting Ethereum into being a fundamentally new and more powerful kind of decentralised network.”

“Over the next four years, expect to see the full extent of this vision roll out.”

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.