- Cosmo Jiang has overseen more than 20 deals for Pantera Capital.

- Running a successful crypto treasury firm typically boils down to one thing, he told DL News.

- The digital asset treasury trend peaked this summer.

Cosmo Jiang knows a thing or two about public companies pivoting to crypto.

After more than 20 deals and over $500 million deployed, Pantera Capital’s general partner identified what separates the successes from the pack.

And it revolves primarily around knowing your audience.

“A lot of people in crypto don’t realise that the whole name of the ball game in equities is you have to appeal to equity investors,” Jiang told DL News.

“And in the real world, people care about fundamentals.”

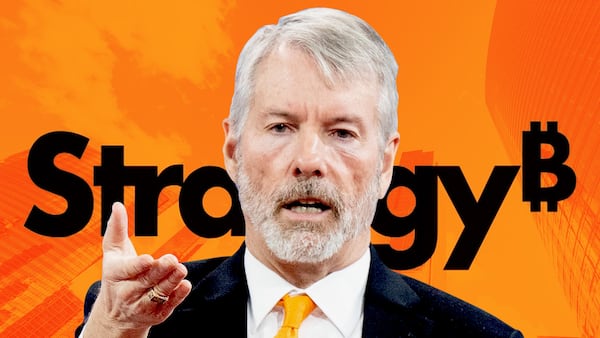

Saylor copycats

Michael Saylor pioneered the corporate crypto treasury trend with his software company Strategy when the company, then called MicroStrategy, began to buy Bitcoin in 2020.

Since then, its share price has increased in value 20 times over, and it has joined the coveted ranks of the Nasdaq-100.

‘Whenever anyone is setting these up, whether it’s a bank, or lawyer, or a sponsor, they’re usually calling me or my team first.’

— Cosmo Jiang, general partner at Pantera Capital

This year, dozens of publicly listed companies have attempted to replicate that success by suddenly beginning to scoop up millions in different cryptocurrencies.

These budding digital asset treasury, or DAT, firms come from fields ranging from pharmaceuticals and biotechnology, to esports and hotels.

The thesis is roughly the same across the board. Publicly traded companies are either bought out by a team or merge with another company and begin acquiring as much of a specific cryptocurrency as they can.

The means by which they fund these acquisitions varies, and can include issuing more stock to investors, selling debt, or selling off other portions of the business for cash.

For many of these vehicles, Jiang has played a key role.

“With all due respect to Michael Saylor for starting all this, I was the guy that kick-started this whole thing in the US,” Jiang told DL News.

“Whenever anyone is setting these up, whether it’s a bank, or lawyer, or a sponsor, they’re usually calling me or my team first.”

Crypto majors

Though the vast majority of these DATs have coalesced around a few key assets, such as Bitcoin, Ethereum, and Solana, the trend has also shifted towards much smaller, lesser-known cryptocurrencies.

That has included a treasury vehicle for Justin Sun’s TRON Network token, crypto exchange Crypto.com’s CRO token, and even the popular memecoin Dogecoin.

For Jiang, these smaller altcoins are a hard sell for traditional investors.

“Even though crypto people like trading them, they don’t even pass the sniff test for anyone normal in the real world,” said Jiang.

Indeed, for the Pantera exec, this is one of the primary reasons a project fizzes out.

“That’s where we’ve seen the failures,” he said. “You need to be able to talk the talk and speak to mainstream financial media and mainstream retail.”

‘Genesis phase’

These days, deals are coming in much slower than earlier in the year.

Unlike the beginning of 2025, during what Jiang calls the “genesis phase,” the impetus is now on the established teams to execute their plans — namely, acquiring more crypto.

“The North Star metric is your tokens per share, that is what matters the most,” he said.

Liam Kelly is DL News’ Berlin-based DeFi correspondent. Have a tip? Get in touch at liam@dlnews.com.