- The House Financial Services Committee debated an ambitious bill that would tailor market structure for digital assets.

- Committee Democrats laid into the bill, saying it could pave the way for the next FTX.

The ghost of FTX loomed dark over Congress as a new crypto bill was debated on Wednesday morning.

Tensions ran high as the House Financial Services Committee haggled over a bill some lawmakers slammed as “the worst piece of legislation” ever to darken the halls of the committee, during a so-called mark-up.

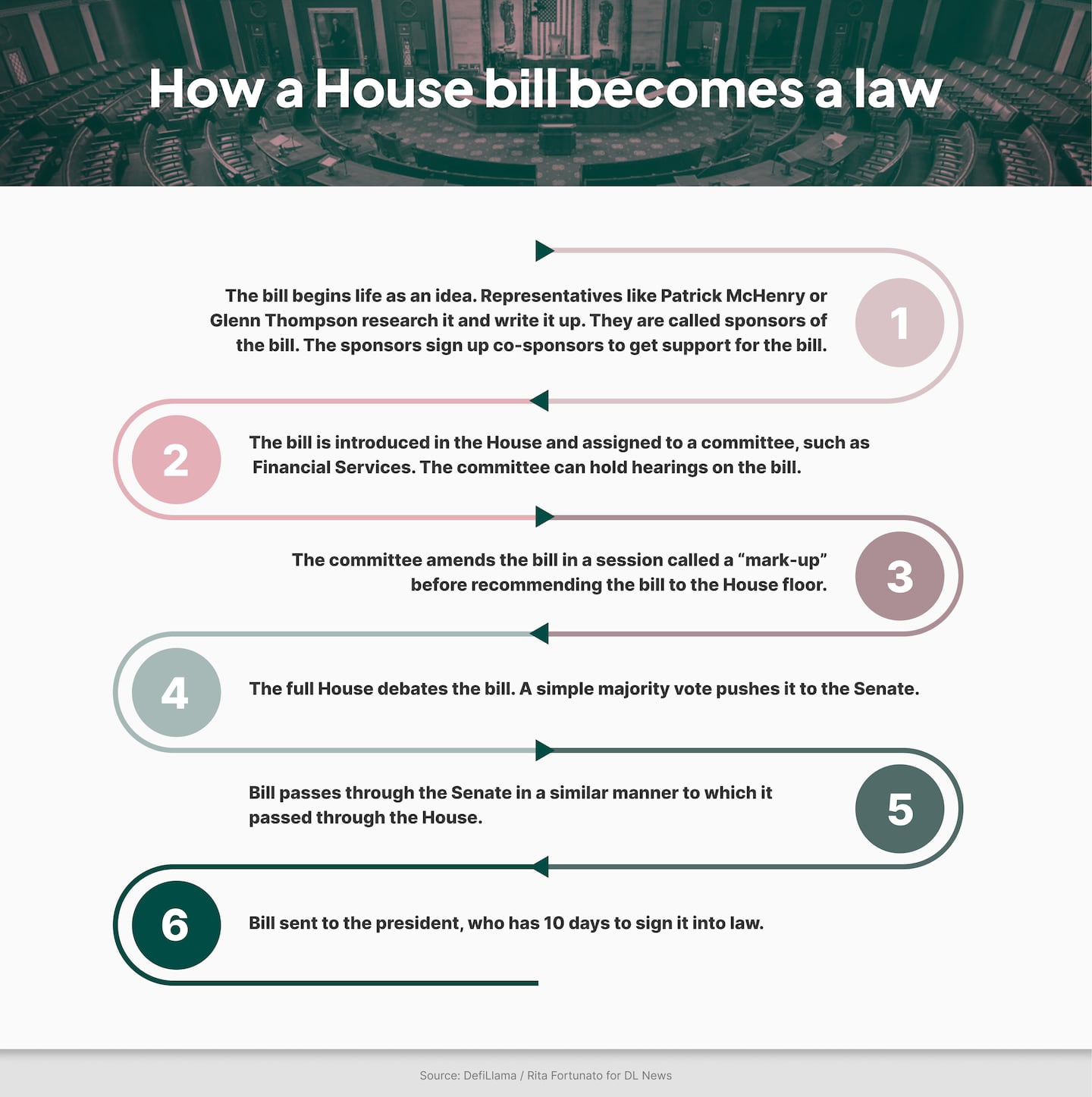

A mark-up is a debate where lawmakers have the opportunity to make changes to a draft law.

Some legislators were quick to point out how the bill partially resembled what Sam Bankman-Fried, the disgraced founder of FTX, heavily lobbied for before he was defenestrated from his own crypto empire

‘The scent of Sam Bankman-Fried still wafts in the air here in the Rayburn Building.’

— Brad Sherman

“The scent of Sam Bankman-Fried still wafts in the air here in the Rayburn Building,” Democratic representative Brad Sherman said, referring to the Washington, DC, home of the House of Representatives.

The key sticking point for high-ranking Democrats in the committee: the bill gives authority over crypto to the Commodity Futures Trading Commission, effectively deciding the winner of its turf war with the Securities and Exchange Commission. Both agencies have made moves to regulate crypto.

Before he was presented with criminal charges for his role in the FTX dumpster fire, Bankman-Fried lobbied hard for legislation that would have granted authority over crypto to the CFTC, something Democratic lawmakers vehemently pointed out.

“A criminal in fuzzy hair and shorts with one objective — keep the SEC out of cryptocurrency,” Sherman said. “Today the crypto billionaire bros have the same objective, though they are attired more conventionally.”

Sherman said the bill does not provide funding to either the SEC or the CFTC to enforce the bill.

Nor does it confer extraterritorial authority on the SEC to protect Americans from fraudulent business based in offshore tax havens like the Bahamas, he said.

Committee Republicans countered that the Agriculture committee will provide $120 million in funding for the CFTC.

NOW READ: SEC’s carbon ETF delay signals wait on Bitcoin nod for Ark, BlackRock

CFTC chair Rostin Behnam has said his agency needs $120 million over the next three years to meet extra obligations related to crypto.

But Democratic lawmakers noted on Wednesday that there was no guarantee that the Treasury would cough up the money.

The committee Democrats weren’t, however, unanimous in their opposition to the bill, which has been refined over the past few weeks in bipartisan discussions.

Democratic representative James Himes said that while the bill wasn’t perfect, it was better than the status quo, and he would be supporting it.

What’s in the bill?

The bill is the product of an unusual cross-committee collaboration between Financial Services chair Patrick McHenry and Agriculture chair Glenn Thompson, both Republicans.

But a partisan divide is clear in the committee over the bill, with several Democrats warning that it may weaken consumer protections installed by the US’s time-tested securities laws, echoing sentiments raised in an open letter penned by liberal lobby groups earlier in July.

Democratic lawmakers have said that the bill would allow exchanges to commingle assets, a major factor in the blowup of the FTX exchange.

Others said the bill is overly complex and specific, opening up potential loopholes for crypto companies to exploit.

‘I’ve been on this committee for 20 years and I can say unequivocally that this is the worst piece of legislation that has been presented for mark-up in that 20 years.’

— Stephen Lynch

“I’ve been on this committee for 20 years and I can say unequivocally that this is the worst piece of legislation that has been presented for mark-up in that 20 years,” Stephen Lynch, the representative from Massachussets, said on Wednesday.

Democrats particularly objected to how the draft law hands much of the authority over digital assets to the CFTC, without providing the agency with more funding.

READ NOW: House bill would hand 70% of crypto assets to the CFTC. But it needs more money

Some in the crypto industry — including Bankman-Fried — have pushed for the CFTC to be their primary regulator, saying it’s more willing to have dialogue than the SEC.

There is also a perception that the CFTC would be a less strict regulator.

Legal clarity

Republican lawmakers said the draft market structure bill would provide clarity to crypto players and halt the SEC’s aggressive industry crackdown.

Most crucially, it would prevent crypto investment from moving offshore, taking with it a potentially multi-trillion-dollar industry — an argument echoed in places like Australia where the industry is also facing the threat of stricter laws.

‘If Congress does nothing, the United States will miss a huge opportunity’

— Tom Emmer

House majority whip Tom Emmer said the European Union and the United Kingdom had moved to pass their own tailored legal frameworks for crypto.

READ NOW: Elizabeth Warren’s anti-crypto crusade may bolster Wall Street’s land grab in Bitcoin market

“If Congress does nothing, the United States will miss a huge opportunity and Americans will suffer for it,” Emmer said. “What would the internet look like today, if it had been designed by the Chinese Communist Party?

“We have an opportunity to lead globally in designing a future digital economy powered by digital assets that advance American values of privacy, individual sovereignty and free markets.”

Ambitious draft

The crypto market structure bill was first published in June as a discussion draft by McHenry and Thompson.

It was formally introduced on July 21, though McHenry is no longer listed as a co-sponsor. French Hill, also a Republican on Financial Services, has taken his place.

The 212-page bill seeks to adapt existing market structure for securities and derivatives to digital assets, creating a pathway for registration with either the SEC or CFTC.

A fact sheet accompanying the bill said 70% of digital assets are commodities, making the CFTC crypto’s primary regulator. The CFTC also gets complete authority over crypto spot markets.

The House Financial Services Committee was considering a bundle of bills, including the market structure bill, in a legislative process called a “mark-up”. This is one step along a bill’s winding path to becoming law (see graph below).

READ NOW: Stablecoin laws could give US an edge — if they ever get off the ground

On Thursday this week, the committee will present another second mark-up of another bundle of bills.

The star of that lineup is a draft law for stablecoin legislation, sponsored by McHenry. He and the committee’s top Democrat, Maxine Waters, have negotiated this legislation in this Congress and the last.

Waters, however, withdrew support after the collapse of FTX, saying lawmakers needed to go back to the drawing board.

Have a tip or an opinion crypto regulation? Email me at joanna@dlnews.com