- Iran Bitcoin mining subject of senators' letter.

- Influence of ETFs appears in Bitcoin price swings.

- $68m stolen through address poisoning exploit.

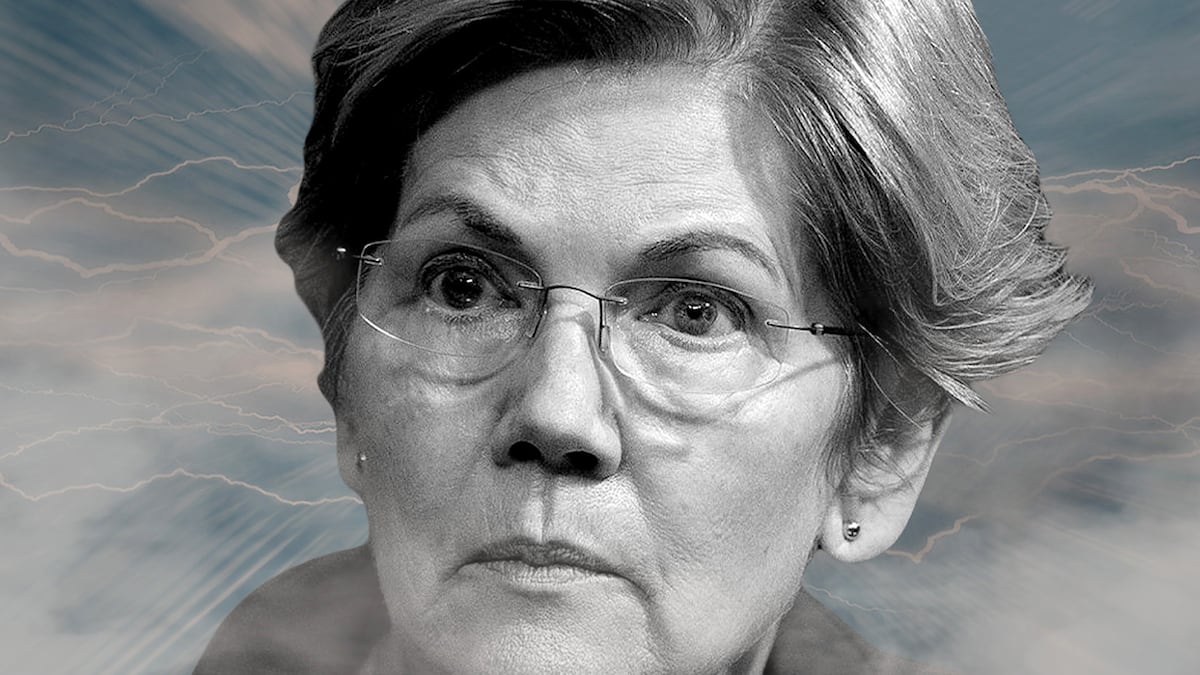

Senators warn on Iran Bitcoin mining

US senators Elizabeth Warren (D-Mass.) and Angus King (I-Maine) this week warned in a letter to government officials that Iran’s Bitcoin mining industry has created a revenue stream big enough to weaken the effects of economic sanctions.

Crypto mining allows Iran “to purchase imports, move funds domestically and internationally, and fund Hamas” and other terrorist organisations, the letter said, adding that this “ongoing activity by the Iranian government threatens our national security.”

The letter, citing numerous sources, noted that Iran is one of the world’s biggest Bitcoin producers, estimated to account for as much as 7% of the global market in 2021, when its mining revenue may have totaled $1 billion.

It went on to say that “Iranian cryptominers are required to sell the crypto they produce to the Iranian central bank, which in turn uses the crypto to pay for imports and exports.”

The letter was sent to Secretary of Defense Lloyd Austin, Secretary of the Treasury Janet Yellen, and National Security Advisor Jake Sullivan, questioning them on what the Biden administration was doing to deter Iran’s evasion of sanctions through crypto mining.

It concluded by posing a series of five questions about Iran’s Bitcoin mining revenue levels since 2021 and its subsequent efforts to launder money and fund terrorist organisations.

It asked that the officials respond with answers by May 16.

Bitcoin prices show influence of ETFs

Bitcoin prices are behaving more like other risk assets since the introduction in January of US spot Bitcoin exchange-traded funds, Bloomberg reported.

After declining during the week, Bitcoin surged about 7% on Friday to more than $62,000 after a government report showed a smaller-than-expected increase in US employment, renewing rate-cut expectations, the report said.

Stéphane Ouellette, chief executive officer of FRNT Financial, told Bloomberg “it was very obvious that this week … Bitcoin was trading in line with other risk assets.”

Address poisoner steals $68m of crypto

A crypto user lost $68 million of wrapped bitcoin in an address poisoning exploit, CoinDesk reported, citing CertiK, a blockchain security company.

Address poisoning means tricking a victim into sending a transaction to the wrong wallet by mimicking the first and last six characters of a wallet address and allowing the sender to overlook the false intervening characters, the report said, noting that addresses can be as long as 42 characters.

Crypto market movers

- Bitcoin is up 6.23% today at $63,062.41.

- Ethereum is up 4.15% today at $3,104.95.