Doma Protocol launched its mainnet today, introducing what could be the most overlooked real-world asset (RWA) category in crypto: website domains. The new protocol, backed by venture capital firm Paradigm, enables users to convert traditional internet domains into programmable, DeFi-compatible tokens.

Premium domain names often sell for six and seven figures, yet the secondary market faces illiquidity and slow transactions. According to industry data, it takes the average premium domain 6–18 months to find a buyer, with brokers earning 10-20% in fees and settlements taking weeks. Doma aims to address these issues in this $360+ billion market through blockchain innovation.

Why Domains? The Internet’s Original Real-World Asset

Domains are among the few digital assets with both economic and infrastructural value. They power core DNS services and email routing, yet remain largely excluded from onchain markets. Despite their widespread use and renewability, domains have yet to establish a modern liquidity infrastructure.

Key structural features:

- Utility yield through annual renewals and routing

- Scarcity-driven upside for premium and TLD-sensitive names

- Regulated ownership under ICANN/registrar governance

- Digital-native format, custody-free, and permissioned.

Market Mismatch: Size vs. Liquidity

According to VeriSign’s Q2 2025 report, there are now 371.7 million registered domain names globally. However, only a small fraction are traded each year. In practice, premium sales listed on GoDaddy Auctions or Sedo often remain unsold for 6–12 months (NamePros 2025 survey of 4,200 domain investors). Even when a deal is agreed, escrow, manual transfer at the registrar, and KYC delays routinely extend closing times beyond 45–90 days.

The Sedo Global Domain Report 2025 highlights persistent fragmentation in the secondary market, where resale prices vary widely, and most activity is focused on a small number of .com and .ai domains. Estimated sell-through rates remain below 3% annually, and most sales require broker intermediation or escrow, limiting accessibility.

Typical cost structure:

- Broker fees: 10–20%

- Upfront listing fees: $70–100

- Settlement times: Often multi-week

- Minimum exposure: Often $10K+ for premium names

Doma Protocol: A Liquidity Layer for DNS Assets

Doma Protocol launched today as a Layer 2 network specifically designed to tokenise traditional DNS domains into programmable, DeFi-compatible assets. Developed by D3 Global, a team led by domain industry veterans and supported by Paradigm, the protocol aims to bridge the structural gap between internet infrastructure and on-chain liquidity markets.

Rather than creating an alternative namespace, Doma retains full DNS compliance. It introduces two ERC-20 token primitives: Domain Ownership Tokens (DOTs), which represent title and transfer rights, and Domain Service Tokens (DSTs), which govern DNS-level functionality. This separation enables domains to retain their real-world utility while becoming interoperable across DeFi ecosystems.

The protocol utilises LayerZero for cross-chain compatibility, supporting networks such as Base, Avalanche, Solana, and the Ethereum Name Service (ENS). Establishing partnerships with InterNetX, NicNames, and EnCirca offers tokenised access to over 30 million existing domains.

Doma’s five-month testnet (June–November 2025) demonstrated strong technical performance and user engagement:

- 35.9 million transactions

- 1.45 million wallet addresses

- 200,000+ domains tokenised

- 94–98% transaction success rate

- $1 million developer fund (Doma Forge) launched to support ecosystem integrations

On the mainnet, the protocol has produced ~3 million blocks and onboarded over 2,700 wallets for initial use.

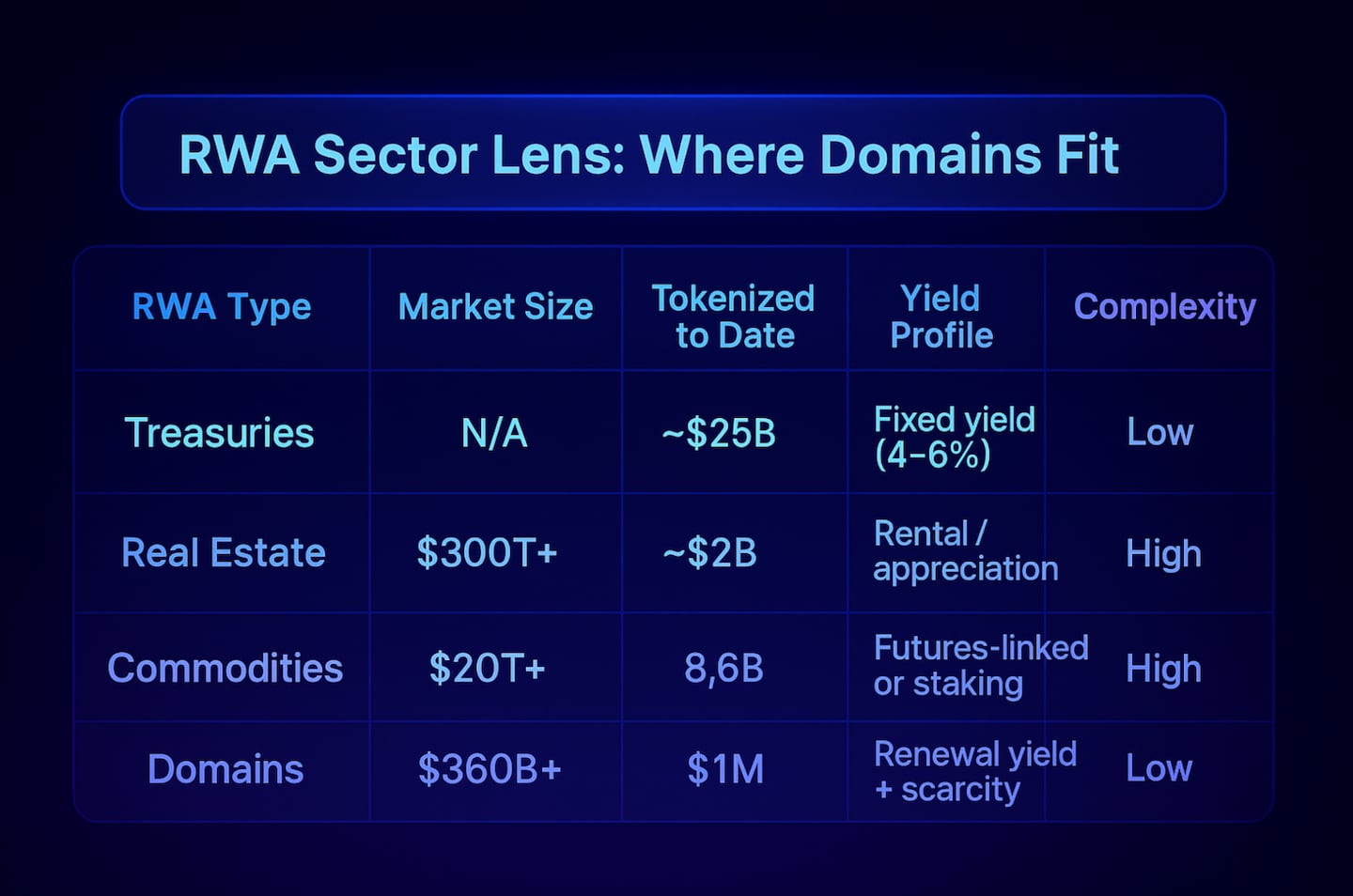

RWA Sector Lens: Where Domains Fit

Doma enters a real-world asset market that has rapidly grown in scope, with treasury-backed tokens alone representing over $23 billion in on-chain value. Real estate and commodities have also gained popularity, with $2 billion and $8.6 billion tokenised, respectively, though both encounter ongoing operational challenges related to custody, compliance, and logistics.

In contrast, domains constitute a digital-native RWA class with a $360 billion total market and minimal infrastructure needs. Unlike real estate or metals, domains require no physical handling, regulatory licensing, or off-chain maintenance, yet provide utility-based yield through renewals and inherent upside linked to digital scarcity. Nonetheless, less than $1 million in domain value has been tokenised so far, leaving the category considerably underpenetrated relative to its size and accessibility profile.

With low overhead, measurable cashflow dynamics, and built-in institutional demand from brands, protocols, and infrastructure providers, domains could offer a more operationally efficient entry point for RWA exposure if adoption and price discovery mechanisms develop further.

Several projects have already experimented with domain tokenisation. Unstoppable Domains and ENS primarily focus on new blockchain-native extensions (.crypto, .eth) or “twin” NFTs that sit alongside traditional DNS records. NameFi provides NFT-wrapped DNS domains on the Ethereum mainnet with fractionalisation features.

Doma’s main difference, according to its team and whitepaper, is being the first platform designed from the ground up for fully ICANN-compliant DNS domains, using a dual-token system (DOTs for ownership, DSTs for ongoing DNS control) and direct registrar partnerships that enable tokenised domains to operate natively for web hosting and email without bridges or workarounds.

Institutional Implications

Doma’s infrastructure introduces domains as a new category of tokenisable infrastructure: digital-native, yield-capable, and governed by existing global systems such as ICANN. For institutional allocators, they offer an unusual combination of productive utility and low operational overhead compared to traditional RWAs such as real estate or commodities.

Tokenisation enables 24/7 tradability, collateralisation, and synthetic exposure, introducing DeFi-native mechanisms to an asset class that has historically been slow, illiquid, and broker-mediated. However, institutional viability will depend on registrar adoption, early liquidity, and clearer frameworks for valuation. If these conditions are met, domains could become one of the most scalable and operationally efficient sectors within the broader RWA thesis.

Doma’s mainnet provides early validation for domains as an overlooked RWA category. While TVL and usage are still in their early stages, the asset class’s fundamentals and the lack of modern liquidity infrastructure indicate that tokenised domains could become a significant part of the wider RWA landscape in the next cycle.