- Family offices bet on crypto like never before in 2025.

- But the $19 billion market wipeout in October worries them.

- Still, Arthur Hayes remains bullish that Bitcoin will hit $200,000 by March.

Family offices are growing concerned about their cryptocurrency investments after roughly $19 billion in digital asset positions were liquidated in October, according to a report from Financial News.

The dip shaved about $1 trillion off the global crypto market’s total value and sent Bitcoin’s price crashing by about 30%.

“The recent dip has hurt the sentiment around crypto among family offices,” a representative of a UAE-registered family office told Financial News.

“Especially when they see extreme volatility, they start comparing it with other investment vehicles in which they are getting stable returns, like real estate.”

About 74% of family offices are investing in or exploring cryptocurrencies, according to a BNY Mellon survey from October.

Investors lose interest

The bearishness among investors grows in contrast to the palpable giddiness among many in the crypto industry, which bets on a favourable environment in 2026.

Since Donald Trump took office in January, the US president has pushed through new crypto laws, appointed industry-friendly regulators, and added sector lobbyists into key government roles — and more legislative overhauls are on the horizon.

Despite this arguably bullish backdrop, investors are losing interest in crypto.

Google searches for “Bitcoin” are at their lowest point since the end of April. Google data about altcoins, such as Ethereum and XRP, paint a similar picture.

Family offices worry

It is against this mise-en-scène that family offices now seem increasingly concerned about investing in digital assets.

The free-falling prices, coupled with market volatility, will continue to be a major challenge in 2026, experts told Financial News.

Some market analysts expect Bitcoin’s price to fall another 90% to $10,000 in 2026, likely putting even more pressure on family offices.

To be sure, not everyone is bearish.

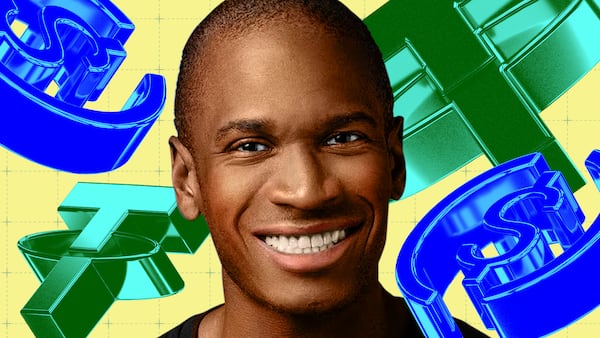

Arthur Hayes, chief investment officer at family office Maelstrom, argues that an influx of liquidity from the Federal Reserve will push Bitcoin’s price to $200,000 by the end of the next quarter.

Maelstrom is planning to raise $250 million for a private equity fund targeting medium-sized crypto firms, Bloomberg reported in October.

Crypto market movers

- Bitcoin is up 0.9% over the past 24 hours to trade at $88,594.

- Ethereum is down 0.1% to trade at $2,972.

What we’re reading

- Just how bad were 2025 Bitcoin price predictions from Hayes, Lee and Saylor?— DL News

- Will Bitcoin price fall to $10,000? Bearish Bloomberg analyst warns of market-wide drawdown — DL News

- Bitwise files for 11 new crypto ETFs tracking Bittensor, Tron and others — The Block

- The top crypto companies of the year are… — Milk Road

- Key dates for US crypto regulation in 2026 — ‘We are closer than ever’ — DL News

Eric Johansson is DL News’ managing editor. Got a tip? Email him at eric@dlnews.com.