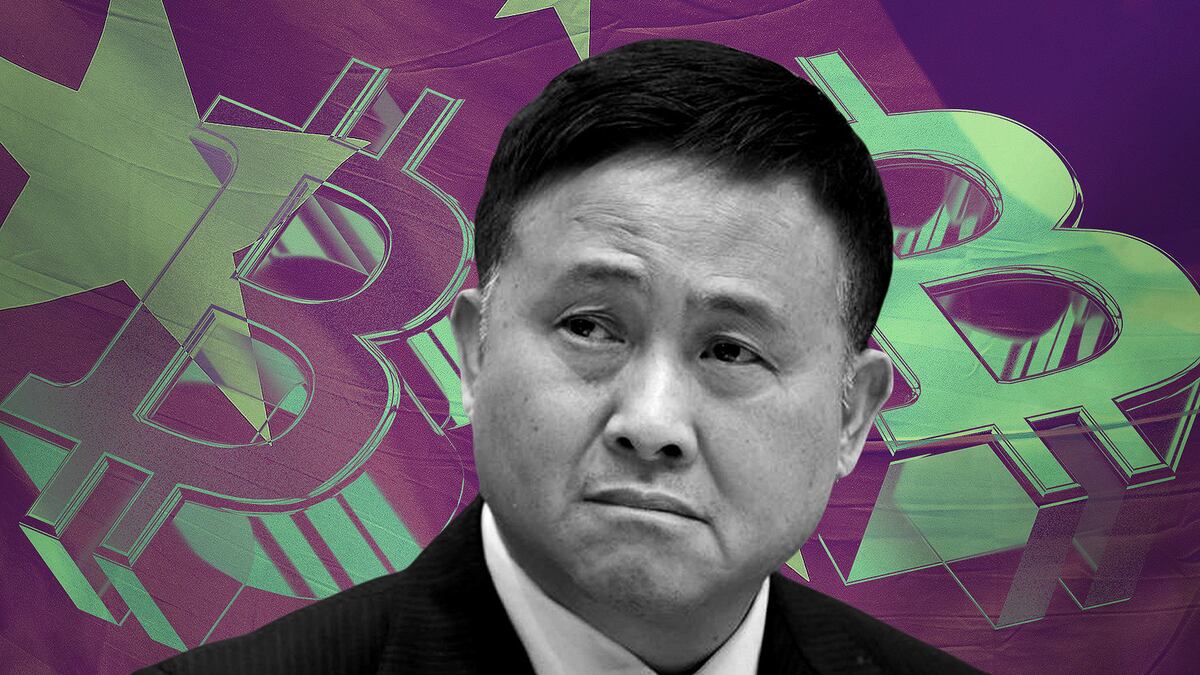

- Pan Gongsheng, tipped to be the next governor of the People’s Bank of China, is poised to continue taking a hard line on cryptocurrency trading and mining.

- China has pushed major blockchain projects to support CBDCs and distributed ledger infrastructure.

- Western-educated economist may take critical position as China struggles to revive its economy.

When it comes to crypto, some hope China is on the rebound.

Hong Kong is reviving as a startup scene, state-run companies are pushing hard to get consumers to use digital yuan, and Beijing is backing an ambitious programme to build blockchain infrastructure for global businesses.

But there may be one major obstacle ahead — Pan Gongsheng, the deputy governor of the People’s Bank of China (PBOC). The Harvard and Cambridge-educated economist is tipped to be the next governor of the central bank.

And he is not a big fan of Bitcoin and its ilk.

Communist party secretary

Now speculation is mounting in both Chinese and foreign press that Pan is set to replace Yi Gang as the governor of the PBOC, which is one of the most influential positions in global banking.

On July 1, he was promoted to the communist party secretary at the central bank. And on July 8, Janet Yellen, the US Secretary of the Treasury, appeared to anticipate another promotion when a readout of her meeting with Pan called him the “head” of the PBOC during her diplomatic visit to Beijing.

Rumours of his appointment have dashed hopes of a reversal on crypto policy in China. He’s been referred to as “anti-Bitcoin” and “Bitcoin’s worst nightmare” in the English-language crypto press.

The characterisations are based on a series of comments he made in the months after the 2017 ICO craze. He referred to Bitcoin as a speculative bubble and likened it to the tulip mania in 17th century Holland – and doesn’t think it will last.

Quoting Keynes

“The market can remain irrational longer than you can remain solvent,” Pan reportedly said at a forum that year, invoking a famed comment from British economist John Maynard Keynes. “Sit by the river, watch, and one day the corpse of Bitcoin will float past you,” Pan added, paraphrasing French economist Éric Pichet.

At the same time, he added he was a “little scared” at the thought of unrestricted digital assets in China.

But his views reflect the general consensus in Beijing about cryptocurrency: it’s volatile, destined to collapse, and has no place in the Chinese financial system.

NOW READ: Multichain workers in China fear for safety after CEO’s arrest, says Fantom boss

Pan has been a steady presence in the commercial banking sector in China for the last 20 years. He earned a Ph.D in economics at the Renmin University of China and then did postdoctoral research at the University of Cambridge in the UK and was a senior research fellow at Harvard University in the US.

Prior to joining the PBOC in December 2012, he held several roles at the Industrial and Commerce Bank of China and served as executive director at the Agricultural Bank of China. Since April 2016, he’s been deputy governor of the central bank and held other senior positions.

‘Sit by the river, watch, and one day the corpse of Bitcoin will float past you.’

— Pan Gongsheng, paraphrasing Éric Pichet

But whether his views on crypto have changed since he last spoke about it publicly isn’t known. “He is a bit of an elusive new character. But he’s also not that public of a figure,” Kai von Carnap, an analyst at the Mercator Institute for China Studies, tells DL News.

Naturally, crypto is not high on the list of priorities for China’s next central bank governor.

The Chinese economic situation, several months on from the relaxation of Covid restrictions, is only just starting to find its feet again. The IMF predicts the economy will expand 5.2% this year following the lifting of pandemic restrictions. But its growth is expected to slow after the reopening boost.

NOW READ: Why China’s rocky CBDC rollout is a ‘severe’ warning sign to Europe and America

“The contraction in real estate remains a major headwind, and there is still some uncertainty around the evolution of the virus. Longer-term, headwinds to growth include a shrinking population and slowing productivity growth,” wrote IMF economist Diego A. Cerdeiro and Sonali Jain-Chandra, another senior official at the fund, earlier this year.

China also wants to instil confidence in foreign investors and businesses who are wary of committing more capital to the nation amid tense relations with the US and the West.

‘He has the kind of background where he can talk to international people, to the Fed, to the ECB. I think that probably gave him the edge over potential competitors.’

— Kai von Carnap

“You need to have this kind of character who can mediate some of the messaging,” von Carnap said. “He has the kind of background where he can talk to international people, to the Fed, to the ECB. I think that probably gave him the edge over potential competitors.”

As head of the PBOC, the digital yuan will also come under his portfolio. Von Carnap points to his expertise as useful for its internationalisation, though he cautions that it is still a mostly domestic project.

But is he in charge?

There has been no official statement yet as to his accession. This week, Yi declined to comment about his possible retirement during a lecture on the digital yuan organised by the Monetary Authority of Singapore.

“My title is right here on the screen,” he said, although according to Channel News Asia a powerpoint at the event called him the “President of the China Society for Finance and Banking” as opposed to governor of the PBOC.

Hong Kong’s crypto push

That said, Yi, 65, was appointed to a second five-year term as governor by the National People’s Congress in March. It’s not clear whether that was for the purpose of helping to usher in a new leader. Yi has reached the retirement age for ministerial officials (Pan himself turns 60 this month).

As for crypto, Chinese entrepreneurs are hopeful that Hong Kong’s push to rekindle startup activity would spur the same story on the mainland. Tron founder and Huobi advisor Justin Sun, gushed about Hong Kong’s new crypto policies to Bloomberg TV late last year.

“Right now they are using Hong Kong as an experiment base so they can see all the feedback, all the results, once they adopt crypto,” he said.

A burgeoning start-up scene in Hong Kong won’t persuade officials in China to abandon their view that cryptocurrencies are little more than a speculative bubble, even if Pan doesn’t take the job.

“I don’t see how Hong Kong regulation would reflect or imply a change in Chinese crypto regulations by any stretch of the imagination,” says von Carnap.

Callan Quinn, based in Hong Kong, covers Asia for DL News. Have a tip on crypto in China? Contact the author at callan@dlnews.com.