- Trump fans bought $550 million of WLFI tokens.

- They're still unable to trade the majority of them.

- The project's creators hold the sole power to decide who can sell and when.

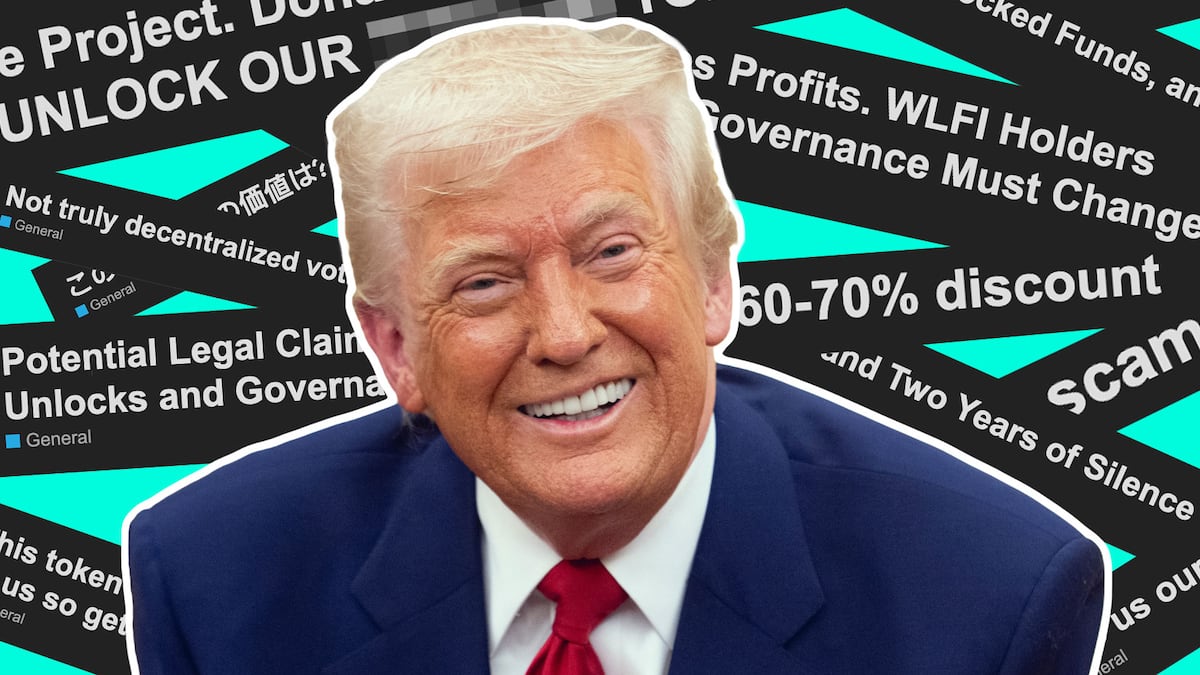

When Trump fans snapped up $550 million worth of WLFI, the token tied to the Trump family’s World Liberty Financial crypto project, they thought they were getting the deal of the century.

Tokens bought for between $0.015 and $0.05 between October 2024 and January 2025 soared to an all-time high of $0.33 when they started trading last September, turning modest purchases into small fortunes overnight — at least on paper.

But there was just one catch.

World Liberty Financial’s creators, which include US President Donald Trump and his sons Eric, Donald Jr., and Barron, granted themselves the sole power to decide who can sell and when.

The project has so far released 20% of the tokens and has promised a vote among holders on when the rest will be made available for trading.

But months have passed, and that vote hasn’t materialised.

Now, dozens of token holders are taking to the World Liberty Financial forum, begging the protocol’s creators to let them cash out as they watch WLFI’s value evaporate.

The token has fallen some 54% over the past five months.

“Nearly 80% of WLFI presale tokens are still locked after almost two years,” said one WLFI holder. “We held through volatility and silence because we believed. But at what point does patience turn into neglect?”

“They are my investments and I want to have access to them,” said another. “We have become hostages.”

The pleas have so far been ignored.

To add to their holders’ woes, World Liberty’s creators pushed through a proposal to distribute WLFI as incentives to encourage more people to use the protocol, potentially putting more pressure on the token’s price.

A World Liberty Financial spokesperson told DL News the project’s team is in frequent and regular contact with its global community.

No guarantees

The situation surrounding the WLFI token echoes that of dozens of other crypto projects.

The industry, which is still largely unregulated, has become a playground for fly-by-night crypto peddlers who promise big, raise millions of dollars, then leave those who bought in out to dry.

Risk-tolerant crypto investors, often lured in by the promise of huge returns, pile into such projects without fully understanding what they are getting into.

It’s a game World Liberty Financial’s co-founders seem to understand well.

Among them is Chase Herro, a former “get-rich-quick” class instructor who has referred to himself as the “dirtbag of the internet.”

In a since-deleted YouTube video, Herro said: “You can literally sell shit in a can, wrapped in piss, covered in human skin, for a billion dollars if the story’s right, because people will buy it.”

When Herro founded World Liberty Financial in 2024 along with an all-star cast of Trump allies — including US Special Envoy to the Middle East Steve Witkoff and his sons, Zach and Alex, and long-time business partner Zachary Folkman — they made no promises.

Buried in the protocol’s so-called gold paper, essentially a long-form marketing pitch, are important details about how the project is set up.

The World Liberty Financial protocol is not directly controlled by WLFI token holders. This has potentially confused token buyers, as other protocols which issue governance tokens do give holders control over the protocol.

The impact is that while token holders can create and propose changes, the protocol’s co-founders screen proposals before voting and reserve the right to block them at their sole discretion.

Additionally, WLFI tokens provide no right to any return, dividend, airdrop or other distribution from the protocol, and there is no guarantee that tokens beyond the initial 20% will ever be made tradable.

This situation leaves unhappy buyers very little recourse.

Even World Liberty Financial’s most high-profile backer, Tron founder Justin Sun, appears to have been shafted.

He bought $75 million worth of WLFI in the project’s token sale. When a portion of that stash was made tradable in September, Sun transferred around $9 million worth to another crypto wallet.

In response, World Liberty’s creators froze the tokens, preventing Sun from selling them.

Sun vowed to buy more WLFI tokens after the incident, which appeared to be a gesture of appeasement toward the protocol’s creators.

His tokens remain frozen and have since plummeted in value.

Democratising finance?

To be sure, not all WLFI holders have buyer’s remorse.

“Most people don’t understand what WLFI will become in the future,” said one token holder on the World Liberty governance forum.

“There will be a transfer of wealth which will make you rich thanks to the blocking of the 80% but you don’t see it yet, it’s a shame.”

Yet even among those who still support World Liberty, there’s a pervasive sense that progress at the protocol, whose token is valued at more than $4 billion, is slower than many had hoped.

The project promises in its gold paper to democratise finance and access to financial opportunities.

Yet so far, the products World Liberty has launched have only enriched its co-founders and done little to benefit token holders.

Its most successful product is the USD1 stablecoin, a competitor to other dollar-pegged assets like Tether’s USDT and Circle’s USDC.

There are currently more than $5 billion USD1 tokens in circulation, making it the fifth-largest stablecoin.

It’s not clear how much money World Liberty makes from USD1. But based on how much Tether makes running a similar product, USD1 likely brings in several hundred million dollars a year.

Per World Liberty’s gold paper, 100% of these profits, plus any other revenue the protocol generates, go straight into the pockets of the Trump family and the Witkoffs, minus $15 million set aside for the protocol’s operating expenses.

Allegations mount

All the while, scrutiny over Trump’s crypto dealings is mounting.

For the president’s political opponents, the issue has become a sticking point in passing the Clarity Act, a broad crypto market-structure bill poised to give the industry a much-needed boost.

Democrats say they can’t support the bill because it allows Trump to continue profiting off crypto.

“The White House has made this infinitely harder,” New Jersey Senator Cory Booker, the bill’s lead Democrat negotiator, said on Thursday.

“I have had private conversations with Republican colleagues and staffers that agree with me. … The fact that Donald Trump is grifting on crypto himself, it’s like me creating a Cory coin,” he added, calling it “ridiculous.”

It’s not a positive development for WLFI token holders caught up in the drama.

At the same time, World Liberty has announced it will hold an in-person forum for the project on February 18 at Mar-a-Lago, Trump’s private luxury club in Palm Beach, Florida.

The invite-only event will “bring together a select group of the smartest people we know and respect from finance and technology,” Donald Trump Jr said in a video message posted on the World Liberty X account.

Whether this will include anyone that represents the interests of WLFI token holders remains to be seen.

Update, January 30: Added a comment from a World Liberty Financial spokesperson.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.