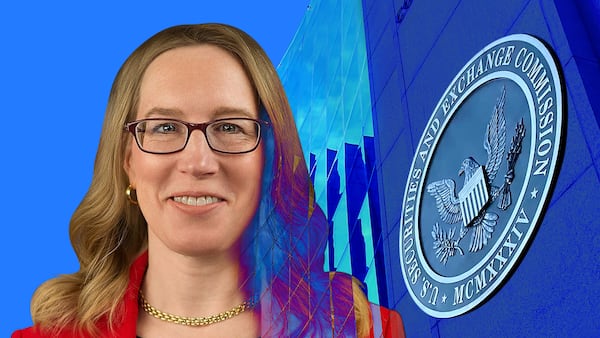

- SEC Chair Paul Atkins wants to “future-proof” changes to US crypto regulation.

- He reiterated his belief the agency should amend rules regarding the trading of securities in order to better accommodate tokenised alternatives.

- Atkins also said he wanted to uphold the “central, fundamental principle” that animates crypto.

Paul Atkins, the chair of the US Securities and Exchange Commission, has embarked on a campaign to overhaul the agency’s crypto regulations.

And he doesn’t want a future administration to promptly undo his hard work.

“What is really important to me is that we future-proof what we’re doing,” Atkins said, “so that whatever happens down the road, we don’t have the pendulum swinging the other way, and then having a lot of our efforts washed away.”

He did not say what steps the agency would take in its attempt to lock in forthcoming changes.

Atkins was speaking at the Blockchain Association’s fourth annual policy summit in Washington, DC. Other speakers included US Treasury Secretary Howard Lutnick, Comptroller of the Currency Jonathan Gould, and several US lawmakers.

Atkins’ campaign, dubbed “Project Crypto,” has drawn praise from the industry since it was announced in July.

At the time, he said the “plan for crypto market primacy” would consider benefits and risks of “moving our markets from an off-chain environment to an on-chain one.”

SEC staff were told to develop proposals that would address lingering confusion over the regulatory status of crypto assets, make it easier for traditional financial institutions to hold crypto on customers’ behalf, enable the creation of all-in-one financial “super-apps,” and “unleash the potential of on-chain software systems in our securities markets.”

In a November speech at the Federal Reserve Bank of Philadelphia, Atkins expounded on his crypto philosophy. In short, crypto assets fall into four categories: digital commodities, digital collectibles, digital tools, and tokenised securities.

Of the four, only tokenised securities should be considered securities subject to SEC regulation, Atkins said in his November speech.

Tokenised securities will be the focus of the SEC’s crypto efforts moving forward, Atkins said on Tuesday. He specifically pointed to rules that govern the trading of securities as ripe for change. Such change would be needed in order to accommodate the onchain trading of tokenised equities.

“Not all of [those regulations] really make sense in a tokenised onchain world,” the chairman said.

The plan has its opponents, however. In a letter addressed to the SEC this month, Citadel Securities, one of the largest market makers in the US, said relaxing such rules could fracture US equities markets by privileging decentralised exchanges over their traditional counterparts.

Atkins also dismissed any possibility he would have the SEC wall off traditional markets from the much smaller, but more volatile, crypto market.

“As far as private blockchains, walled gardens, whatever you wants to call them, I think the whole ethos behind distributed ledger technology is interoperability and freedom of movement. That is the central, fundamental principle that we ought to uphold,” Atkins said.

“So let people innovate. Let the market decide what it wants to do.”

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can reach him at aleks@dlnews.com.