- Commissioner Peirce says tokens rewarding work shouldn’t be treated as securities.

- Industry voices call it a “flashing green light” for builders under Trump-era SEC.

Crypto builders are celebrating fresh clarity from America’s top financial markets regulator.

The Securities and Exchange Commission used to be “a hammer, and everything related to digital assets was a nail,” Rich Shorten, founder of staking platform GlobalStake, told DL News.

But the no-action decision issued on September 29 for the decentralised crypto project DoubleZero “is a flashing green light” that the SEC has begun to “actually engage in the details — and that’s a very, very positive thing.”

For years, crypto firms have complained that US regulators treated every token as a potential security.

To those celebrating the agency’s no action note, it sets a precedent that some tokens can operate outside securities law, giving builders the confidence to expand in the US without fear of regulatory whiplash, and eases the integration of digital assets into mainstream finance.

It also signals that the SEC under President Donald Trump’s administration is “open for business,” Shorten said.

The decisive move marks a sharp break from the previous era when crypto teams faced only “delay and silence, at best, or enforcement action, at worst.”

To be sure, Amanda Fischer, the former SEC chief of staff, noted that the regulator issued a no-action letter to blockchain gaming platform Pocketful of Quarters “years ago.”

Regulatory win

Even so, the new letter is more “about the signal it sends that projects and investors can expect the SEC to actually engage with the fine details of digital assets, just as they do in countless other non-digital contexts,” Shorten said.

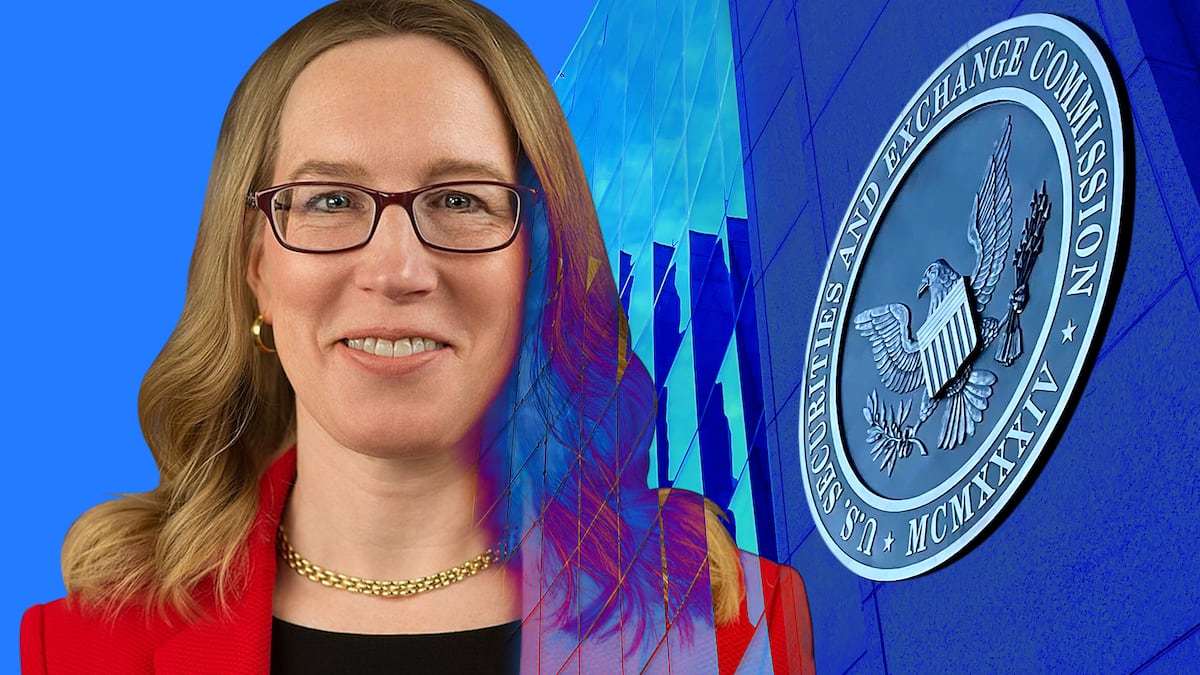

In the decision on DoubleZero, Commissioner Hester Peirce argued that tokens used to reward participants for providing storage, bandwidth, or other services don’t fit the definition of securities.

The decision focused on DePIN projects, which reward people for providing real-world services like storage or bandwidth. Tokens distributed as compensation for those services don’t fall under the agency’s criteria as investment contracts, the SEC said.

“These tokens are neither shares of stock in a company, nor promises of profits from the managerial efforts of others,” Peirce wrote. “They are functional incentives designed to encourage infrastructure buildout.”

“Blockchain technology cannot reach its full potential if we force all activities into existing financial market regulatory frameworks,” Peirce said.

The new clarity “will accelerate the growth of networks that deliver measurable value” for the DePIN sector which could grow from $30-50 billion today to $3.5 trillion by 2028, Arie Trouw, co-founder and CEO of blockchain company XY Labs, told DL News.

The new stance narrows the SEC’s reach in a way that helps rather than hinders innovation, Roman Giler, head of business development at infrastructure network Tanssi, told DL News.

“The SEC finally drew a line between utility and fundraising,” he told DL News. “DePIN tokens reward work, not passive speculation — so the Howey Test, which is about investing money to profit from others’ efforts, just doesn’t fit.”

Giler added that this redefines the agency’s scope in a constructive way.

“The new leadership seems to recognise that the SEC’s role is to oversee securities markets, not to stretch into every corner of economic activity,” he said.

“That’s an important reset.”

Crypto market movers

- Bitcoin is up 1.5% over the past 24 hours to trade at $115,00

- Ethereum is up 1.1% over the past 24 hours, trading at $4,200.

What we’re reading

- The real flippening? Ethereum treasuries overtake Bitcoin — DL News

- Yearn Finance overhaul to give 90% of revenue to token stakers— DL News

- This DAT Claims It Raised $401 Million. But the Fresh Capital Is Only $13.7M — Unchained

- Will AI Manage Your Crypto Better Than You? w/ Sandy Kaul— Milk Road

- Solana ETF approval now ‘100% certain,’ says analyst— DL News

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.